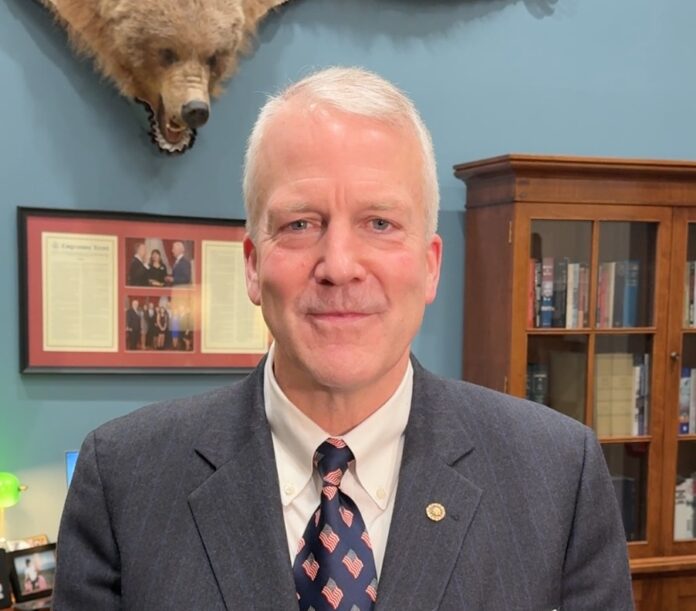

US. Senator Dan Sullivan explained his vote in favor of the sweeping One Big Beautiful Bill Act of 2025, calling it a historic legislative victory for Alaska that delivers major advancements in energy development, tax relief, military investment, border security, health care, and more.

Sullivan said the legislation, the product of months of negotiations, includes provisions that prioritize Alaska and will benefit the state for generations. “No state fared better from this bill,” he said, pointing to the law’s broad scope and targeted focus on unlocking Alaska’s economic and strategic potential.

The bill includes mandates for extensive energy leasing across Alaska’s resource-rich lands. It requires:

- At least four new area-wide lease sales in the Arctic National Wildlife Refuge (ANWR) over the next decade,

- Resumption of at least five lease sales in the National Petroleum Reserve-Alaska (NPR-A),

- A minimum of six lease sales over 10 years in Cook Inlet.

The legislation restores leasing frameworks from the first Trump administration and increases the state’s share of resource revenue to 70 percent for future leases. This is less than the 90% for Alaska that was first proposed in the bill by Rep. Nick Begich, but is far higher than the current state share of 50%.

It also streamlines federal environmental reviews by enabling project sponsors to opt into expedited timelines through a fee-based system.

Additionally, the bill encourages increased timber harvests and long-term logging contracts on federal lands, including the Tongass National Forest, and creates an Energy Dominance Financing program to support major projects such as Alaska LNG.

The bill locks in permanent lower tax rates and averts what would have been a $4 trillion tax increase. It enhances the Child Tax Credit, expands the standard deduction used by over 90 percent of taxpayers, strengthens the Child and Dependent Care Tax Credit, and maintains small business deductions that promote local economic growth.

Sullivan, who chairs the Commerce Subcommittee overseeing the U.S. Coast Guard, secured nearly $25 billion in funding for the service—the largest investment in its history. This includes funding for 16 new icebreakers and $300 million to homeport the Coast Guard icebreaker Storis in Juneau.

The bill also advances the Golden Dome initiative, bolstering homeland missile defense with new interceptors, sensors, and radar—centered in Alaska—and promotes redevelopment of Arctic infrastructure such as the Adak Naval Base.

The legislation includes what Sullivan called the most robust border enforcement package in a generation. It allocates $46 billion for physical border barriers, boosts funding for Border Patrol and law enforcement, and enhances efforts to stop the flow of fentanyl, including in Alaska.

Sullivan said the bill will direct approximately $200 million annually for five years toward modernizing Alaska’s health care system. The funding aims to stabilize rural health providers, improve outcomes, and preserve access to care in underserved communities.

The law also introduces new work requirements for Medicaid and SNAP benefits, with flexibility granted to Alaska to accommodate the state’s unique challenges. These changes are designed to preserve benefits for the truly vulnerable, including single parents and individuals with disabilities or mental illness.

The One Big Beautiful Bill Act of 2025:

- Requires BLM to hold at least 4 additional area-wide ANWR lease sales in the Coastal Plain over the next 10 years, with revenues divided 70 percent for the State of Alaska and 30 percent for the federal government starting in 2034—up from 50 percent;

- Requires the Secretary of the Interior to expeditiously restore and resume lease sales under the NPR–A oil and gas program as directed by federal law—5 lease sales within 10 years of enactment under terms, conditions, stipulations, and areas described in the first Trump administration’s 2020 NPR-A Integrated Activity Plan and Final Environmental Impact Statement and Record of Decision—and directs that the State of Alaska receive 70 percent of revenues generated from development activity on future leases starting in 2034–up from 50 percent;

- Requires a minimum of six lease sales over 10 years in Cook Inlet, with at least 1 million acres per sale and with revenues divided 70 percent for the State of Alaska and 30 percent for the federal government starting in 2034—up from 27 percent;

- Reverses the Biden-era royalty hike by reinstating a lower 12.5-16.67 percent on offshore and onshore federal oil and gas leases;

- Restores commonsense leasing rules that we saw under the first Trump administration that are a prerequisite to generating federal revenues from production in both the NPR-A and in ANWR—more lands, more leasing on a more prescriptive timeline;

- Streamlines the NEPA environmental review process by allowing project sponsors to opt in for faster timelines through a fee-based system, halving review periods;

- Includes a $5 billion increase for critical minerals supply chains, opening new opportunities for Alaska’s mining industry;

- Requires increased timber harvests and long-term contracts in national forests and public lands, including in the Tongass National Forest;

- Creates a new Energy Dominance Financing program within the Department of Energy to support enhancement and development of reliable energy infrastructure, providing another vehicle for the Alaska LNG project to accelerate development of the gasline;

- Places a 10-year moratorium on the methane tax; and

- Provides $1 billion for the Defense Production Act to conduct critical mineral mining operations, including in Alaska.

In tax relief, the bill:

- Avoids a massive $4.5 trillion tax increase on Americans by extending the 2017 tax cuts;

- Institutes a permanent $2,200 child tax credit and tax relief amounting to an estimated annual take-home pay increase of $7,600-$10,900 for a family of four;

- Expands tax credits to make child care more affordable for the thousands of working families in Alaska that are in need of quality, affordable child care:

- Specifically, this bill enhances the Child and Dependent Care Tax Credit, the only tax credit that specifically helps working parents offset the cost of child care. This provision builds on stand-alone legislation that Sen. Sullivan cosponsored;

- Improves the Employer-Provided Child Care Credit which supports businesses that want to help locate or provide child care for employees;

- Expands the Dependent Care Assistance Plan which creates flexible spending accounts that allow working parents to set aside pre-tax dollars to pay for child care expenses;

- Eliminates taxes on tips and overtime for millions of workers, and taxes on auto loan interest for new American-made vehicles;

- Expands tax relief for small businesses, which constitute 99.1 percent of businesses in Alaska, benefiting the backbone of Alaska’s economy; and

- Makes permanent the opportunity zone, low-income housing, and new markets tax credits—key incentives for economic development and affordable housing, and adds greater emphasis on economically disadvantaged and rural areas.

Sen. Sullivan described the final package as the result of months of “relentless, focused work on behalf of Alaskans—and it delivers significant wins for our state.”