SURGE WEEK

This week is the home stretch for signing up for Obamacare for 2018. The enrollment period ends Friday, Dec. 15.

Health care experts are now saying enrollment will be down by 18.5 percent from last year.

Find out more about enrolling in a health care plan here.

So far, Alaska (population 740,000) has the lowest number of people enrolled in the nation, at 10,633. The next lowest is Delaware, with a population of 950,000 and an Obamacare enrollment of 11,553, as of Dec. 9.

TOTAL ALASKA ENROLLED TRENDS

2016 = 23,029

2017 = 19,145

2018 – 15,600 (projected by Must Read Alaska)

Number of Alaskans enrolled as of Dec. 9: 10,633

Oddly, Alaska enrollments to date actually appear 22 percent higher than last year, according to the Centers for Medicare and Medicaid Services. That is likely due to a shortened six-week open enrollment period, compared to 12 weeks last year.

EFFECTUATED ENROLLMENT (ENROLLED & PAID FIRST MONTH PREMIUM)

Enrolling in health care is one thing, but paying for it and having it actually cover you is another. Many enrollees drop out of coverage before they pay their first premium. Cost is a factor: Alaskans pay some of the highest premiums in the nation.

Here’s where the real Alaska enrollment numbers come in:

2016 = 15,252 effectuated

2017 = 14,177 effectuated

2018 = 10,800 +- (effectuated, projected by Must Read Alaska)

Republican lawmakers will overturn the mandate to purchase insurance, a cornerstone of the Affordable Care Act, which passed with only Democrats voting for it.

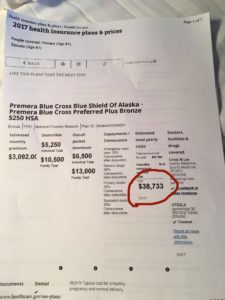

As it stands, the law now requires all to have insurance or pay a fine. This portion of Obamacare hits small businesses and sole proprietors hard, since they typically do not have company-provided health care plan. Many Alaskans report premiums and deductibles that are more than their home mortgages, such as this example sent to Must Read Alaska.

The Internal Revenue Service has announced the fines will be enforced when people file their taxes between Jan. 1-April 16, 2018. The release of that fine would not go into effect until the following year, unless something changes.

The tax bill now being worked out in a congressional conference committee between the House and Senate has the end of the individual mandate written into it.