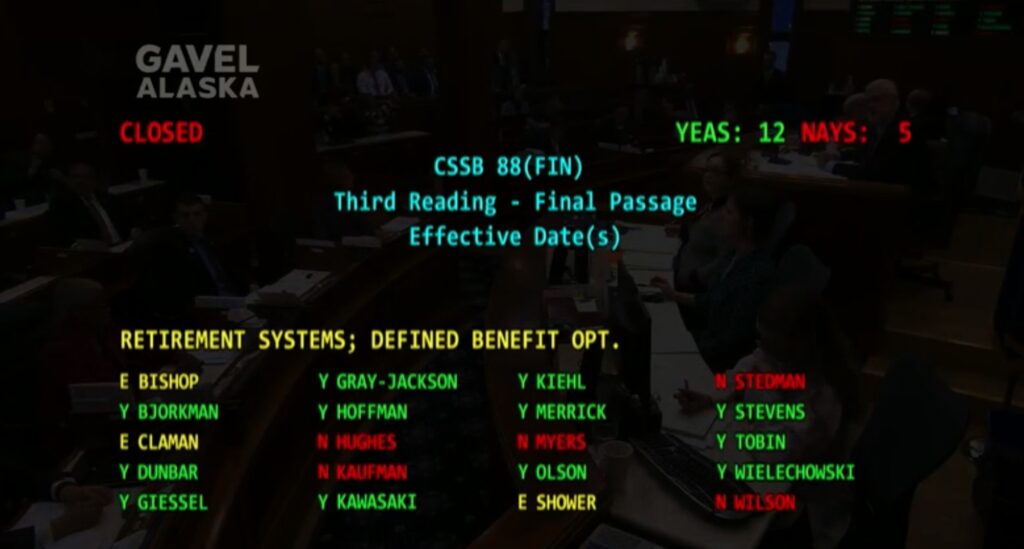

Senate Bill 88 is the dream legislation of the government unions. It would restore a defined pension plan for state, local, and public education employees. But no one knows how much it will really cost, because there is no complete fiscal note on the bill.

SB 88 will now go to the House, where it will likely be referred to at least three committees for vetting, since it is inadequately understood by its Senate sponsors.

Usually, the saying goes in the Legislature, “If you have the votes, then vote. If you don’t have the votes, then talk.” But with the Senate gallery filled with government union representatives, pro-pension senators took up over two hours, mostly justifying why the bill should get approved.

Bill sponsor Sen. Cathy Giessel spoke at length and claimed it is not a gold-plated plan, and she promised, without evidence, that it would “turn the tide on our workforce recruitment and retention issues. We must take significant action now if we want to turn around our economy and attract the brightest in best in all industries, public and private.”

The bill only applies to public employees, however.

The 11 SB 88 sponsors believe that they can turn around the outmigration of people in Alaska by luring them into government jobs with good pension plans. The problem described by the Senate — not enough workers — is being experienced across the country.

“One primary reason that has been cited for recruitment and retention issues is the lack of a quality retirement system that public servants can depend on once they retire,” the Senate majority said in a press release.

In 2006, the state of Alaska transitioned into a defined contribution plan, similar to a 401(k)-retirement plan, as the pension plan began to show signs of crippling costs to the state.

Sen. Bert Stedman, who was one of the senators around in 2006 who pushed to get the pension plan retired and replaced with a contribution plan similar to a 401K, pointed out that there is an incomplete fiscal note with the SB 88, so he was going to be a “no” vote.

“I’m concerned about the cost neutralness of this bill. I don’t think it is cost neutral,” he said. “The normal cost is higher than some of of that calculated over at Leg. Finance.”

Stedman said that the individual retirement account has become a portable item that is used as a pooling mechanism for workers as they change employers. It’s the model across the country now. He noted that on the last pension plan, which he helped end in 2006, the state still owes $6 billion.

But Sen. Jesse Bjorkman of North Kenai, who served as a union representative for his school district, spoke at length about the benefits of pension plans, and said it was “likely cost neutral” and that the matter had been “vetted over a decade ago.”

Americans for Prosperity-Alaska, a grassroots group active in political life in Alaska, will be trying to stop the Legislature from approving this bill.

AFP-AK State Director Bethany Marcum said, “Returning to a defined benefit pension plan would be disastrous to the state’s budget and would cost Alaska upwards of $9 billion in avoidable expenses. Simply put – Alaskans can’t afford this misguided legislation.”