After the House Speaker said the work of the House was done, the Senate convened today and passed a $1,100 Permanent Fund dividend with House Bill 3003.

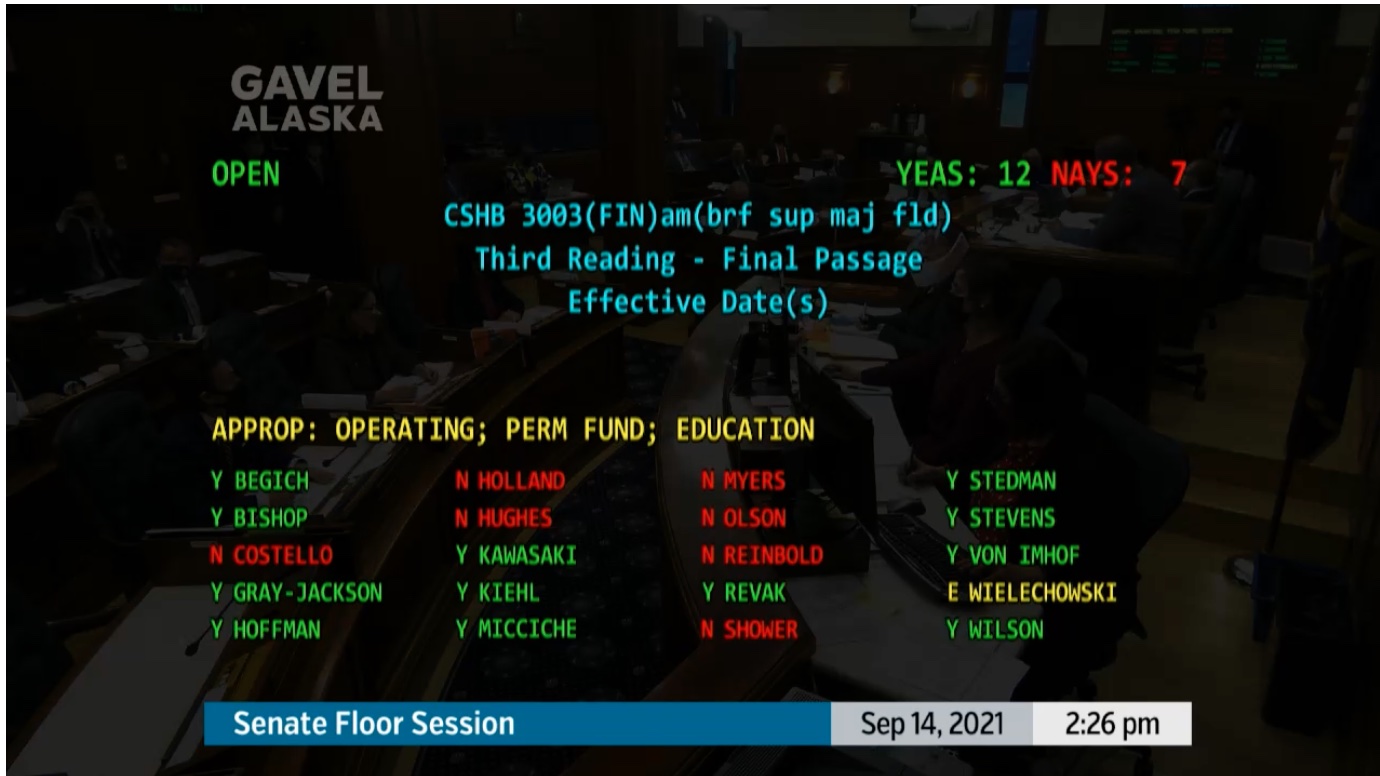

The vote was 12-7, with Senate President Peter Micciche among those voting in favor of the PFD that is one third of the statutory amount.

This year’s dividend will cost the treasury about $730, if it is not vetoed by the governor. Gov. Mike Dunleavy has said he may veto the dividend again and call the House and Senate back into a fourth special session to try again.

Although much smaller than the amount set by the governor ($2,350), the $1,100 PFD is larger than the $525 PFD passed by the House and Senate in June, an amount that was vetoed by the governor.