THIS IS BUDGET WEEK FOR THE GOVERNOR

The Alaska fall revenue forecast for the coming fiscal year is out, and it’s not a pretty picture for how the state will pay for services.

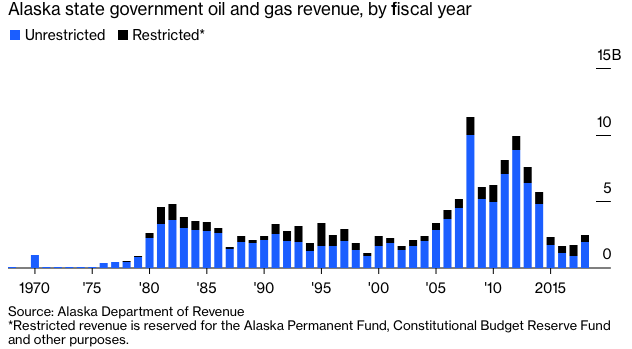

While Unrestricted General Fund revenue totaled $2.6 billion in Fiscal Year 2019 and is forecast to be $2.1 billion in FY 2020, it will drop to $2.0 billion in FY 2021.

The drop of $600 million in three years of revenues makes the coming budget cycle at least as challenging as the last one, where Alaska lawmakers and the governor struggled to balance spending with diminishing revenue. After the governor offered his budget last year, it was only days before the drumbeat of “Recall Dunleavy” started among Democrats.

The revenue forecast excludes some $2.9 billion that the Permanent Fund Earnings Reserve Account will transfer to the General Fund this budget cycle. That figure will increase to $3.1 billion in FY 2021 — funds that pay for Permanent Fund dividends and for general government.

One of the main drivers of the falling revenue forecast is the anticipated price of oil, which is falling. While North Slope crude averaged $69.46 in FY 2019, it’s now projected at $63.54 for FY 2020. But for FY 2021, it will drop to $59 a barrel, according to the Department of Revenue.

While prices are softening, the overall production is still sagging, and new oil fields and finds won’t fill the gap until later in the 2020s, when production will come roaring back due to the stable tax policy of SB 21, passed in 2013 by the Legislature and given a vote of confidence by the public in 2014 during a referendum to toss it out.

But bringing oil online in today’s regulatory environment is a long game, and if tax policies change under the Our Fair Share initiative that is now collecting signatures, the investment decisions on new fields may be put back on the shelf by the oil companies that would bring that oil to market.

For FY 2019, North Slope oil production averaged 496,900 barrels per day. The forecast assumes that production will decline to 492,100 barrels per day in FY 2020 and 490,500 barrels per day in FY 2021.

That is a 1.25 percent drop, but represents millions lost in taxes and royalties to the state. The Department of Revenue projects there will be $200 million less in those payments by oil companies, primarily because of the downward trend of oil prices.

Gov. Dunleavy is expected to roll out his proposed state budget for the coming year. It’s due before Dec. 15, and it’s a solid bet that he will not release the budget on Friday, Dec. 13, but likely will do the big reveal midweek.

The revenue forecast is a piece of the process, meant to advise the governor and Legislature in making budget decisions for the fiscal year that will start July 1.

In the 42 years since oil started moving through the Trans Alaska Pipeline system, Alaska has paid for state services using oil and gas revenues, which have comprised 83 percent of the unrestricted State General Fund. The pipeline is currently moving less than one-quarter of its capacity.

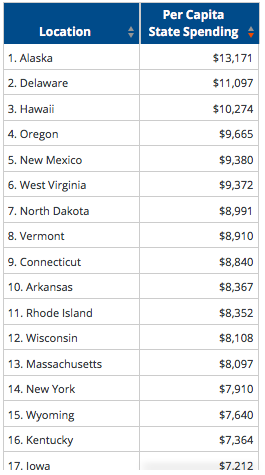

Since the 2015 drop in oil prices, however, the revenue hasn’t kept up with the expenditures, which are the highest per capita in the nation, according to KFF.org.