TRUSTEES HEAR PITCHES ON ENVIRONMENTAL INVESTING

The Alaska Permanent Fund’s investments gained 8.86 percent through the third quarter of fiscal year 2018.

The fund ended March with assets totaling $64.6 billion.

Over the last five years, the fund has returned 8.35 percent, and that compares to a return of 6.52 percent over the last 20 years, which includes the financial crash of 2008-2009, when the value of the fund fell to $26 billion after a peak of $40 billion in 2007.

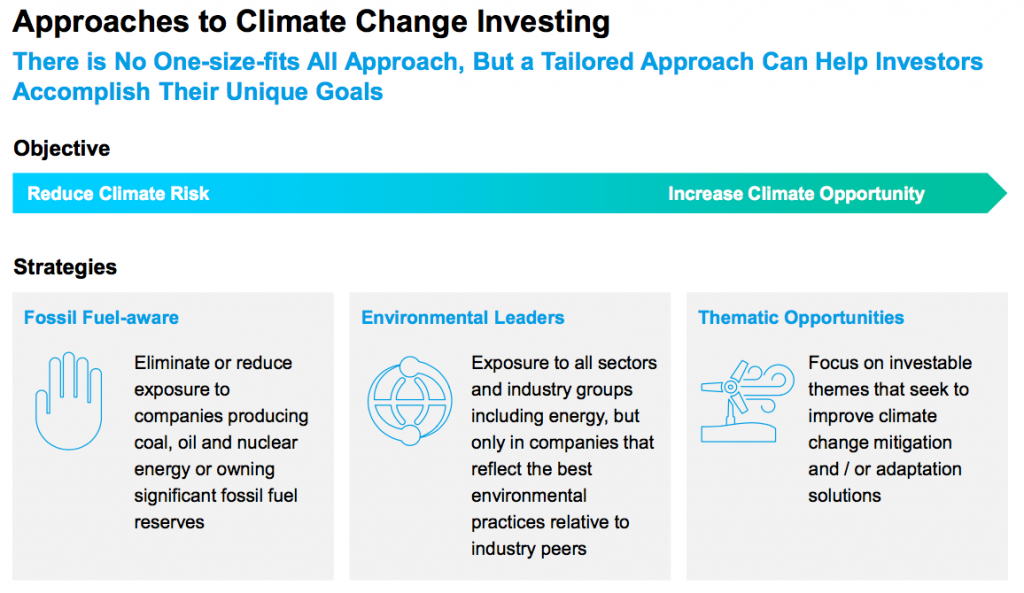

The Board of Trustees met for its quarterly meeting last week in Anchorage to review the performance and risks of the fund’s assets, and to hear a presentation on investing in alternative energies in a strategy called Environmental, Social, and Governance (ESG) investing.

The trustees heard from a former Obama White House official who now works at Blackrock investment group. Brian Deese, the managing director and global head of sustainable investing at BlackRock, was President Obama’s senior advisor for climate and energy policy, helping to negotiate the Paris Climate Agreement and other national and international initiatives.

Deese told the Permanent Trustees that he believes sustainability-related issues including board composition, human capital management, and climate change – have real financial impacts. Those who engage in ESG investing do better, he said, than those who don’t.

“They are more competitive than their peers because they more efficiently use their resources, and/or have better human capital management as well as better manage long term business plans. This leads to higher profitability and higher dividends,” his presentation materials said. “They are less vulnerable to systematic market shocks and therefore show lower systematic risk. Lower systematic risk means a lower beta, which translate to lower cost of capital and a higher valuation. Further valuation is increased through the increased size of investor base.”

Similar presentations were made by John Goldstein, Goldman Sachs’ managing director, ESG and impact investment client strategy; and Hilary Irby, Morgan Stanley’s managing director and co-head of global sustainable finance.

The presentation materials are linked here:

2018_05_23-24_APFC_Board-of-Trustees-Quarterly-Meeting-Packet

Many of the Permanent Fund’s external managers already incorporate ESG strategies alongside their traditional strategies, according to a news release from the Alaska Permanent Fund Corporation. The trustees seemed disinclined to stray from their current successful investment strategy and adopt the carbon-free model.

Groups have attempted to persuade the Permanent Fund in the past to invest in Alaska projects, and Gov. Bill Walker in 2016 asked the trustees to consider buying up the distressed debt the State owed to oil explorers due to the nonpayment of tax credits by the Walker Administration.

The Permanent Fund trustees also reviewed legislative actions including Senate Bill 26, establishing a percent of market value (POMV) draw of $2.7 billion from the Earnings Reserve Account to fund general government services and the dividend program for Alaskans who have lived in the state for one year or longer.

The Legislature implemented a statutory structure for using Permanent Fund’s earnings with the passage of SB 26, limiting appropriations to 5.25 percent of the market value for 2019, 2020, and 2021, and then stepping down to a 5 percent draw beginning on July 1, 2021.

You can see in the information accessible through this news story that the social investment mandate proposals, from Goldman for example, lump Ruger right along with tobacco and coal companies. Former NYC Mayor Michael Bloomberg may be the largest paid provider of financial information to PFC. He spends millions of dollars each year to defeat and abolish the National Rifle Association, and Bloomberg.com carries anti-Second Amendment “news” stories about twice a week. The financial management and money management industry, based in NYC and London, holds very different values than those of mainstream Alaska. PFC and the Department of Revenue probably pay a combined $250 million annually for money management, cash and custodial services, and financial information. Social investing, as a modification if not a forthright departure from the prudent investor rule in Alaska law combined with this kind of money leaving Alaska for places and firms that eschew oil exploration, personal firearms ownership, hard rock mining development, and possibly other economic and cultural facets of Alaska life is a matter that I hope the Alaska media can soon examine.

Don’t think the PFC wealth has gone unnoticed by our brand new BFF’s, our gasline partners, the Communist Chinese.

.

It’ll be interesting to see who gets their hands on it first, the globalists or the Communist Chinese.

.

Bloody well won’t be productive Alaskans, unless we drain our swamp and do it quickly.

So, the sky is not falling! Governor Walker did everything he could to scare Alaskans into thinking that without a State income tax, we were doomed. He even unilaterally took over $1,000 from each resident to prove his point. With crude prices increasing, the PF increasing, and some meaningful cuts, it looks like we will be the envy of the nation when it comes to financial security. All we need now is a new leader in Juneau.

I agree with all of your comment except that $1,000 number. I think that what Walker has taken from the PFD amounts to more like $5,000 from every Alaskan from 3 PFDs. He was the first to depart from the PFD formula, and he did it when the 5 year smoothing was really kicking in for PFD recipients. That is, all 5 years were in a bull market whereas in the PFD years prior to the Walker haircut we were still averaging in part a time when there was a bear market. Perhaps equally bad he has established that from now on there will be an annual tension between the PFD amount and the amount of increase in state operations demanded by lobbyists and bureaucrats. And don’t forget the $1 billion in new debt per HB 331 that will need to be repaid plus interest. We all have a chance to vote this year, and then the die will pretty much be cast. Only Dunleavy has a fiscal plan that restores fiscal discipline and takes us off the road that leads to the end of the PFD within 3 years in my view. After this year and the election of this year it will be up to legislators and lobbyists in Juneau to determine how much the operating budget increases and how much is left for our PFD checks.

I bet these Environmental, Social, and Governance (ESG) investing firms are willing to do this for the good of the environment free of charge right? Oh wait what’s that they are only willing to do this if they are highly compensated, but I thought that climate change doctrine was pure and not driven by corrupt things like money or profit. I wonder if now would be the time to call these people profiteers?

People of Alaska wake up

They are working overtime in Juneau to take the last penny people make

Wow we are so happy our pfd has nice returns ha ha you wont see it.

This governor we have is worse than liberal claims he is conservative all he wants is to tax the living daylights of Alaskans but not cut one dollar from his spending.

All I hear is China China gas to China It’s the best thing can happen to Alaska is China. I have not heard Alaska Alaska for Alaskans make energy affordable to live in Alaska, governor. You looking at wrong place. Turn around, go to DC get the funding let’s print the money and build the pipeline have the gas available for Alaska an the world who is in need of gas.

I bet you we have more investment come our way than China

Tomorrow we turn on each other — we’re doomed

Nick you are so right, rounded of the PFD for an approximate $5000 from my family of wife sons daughter grand children and great grandchildren 19 X $5000 = 95,000. Wonder why I am so againsst Walker. How about you Community say 450 X $5000 – 2,250,000 OR 600 X $5000 3 Million toward the betterment of your self and community. 1 Billion went to the rip off oil companies that could have been paid off by term , new buildings , now high paying jobs for outsiders a Chine gas deal that is being given to China while our people have to choose between feeding the kids or keeping them from freezing or give them electricity. WHAT IS WRONG WITH THIS PICTURE?? Walker and his thiefs in the legislature is what is wrong in this picture. YOU like Walker, WHY???? You must dislike our Alaskan Peeople HANG YOUR HEAD IN SHAME if you do.both. ME I love my Alaska. Don’t let our Alaska FALL.