By MARY ANN PEASE

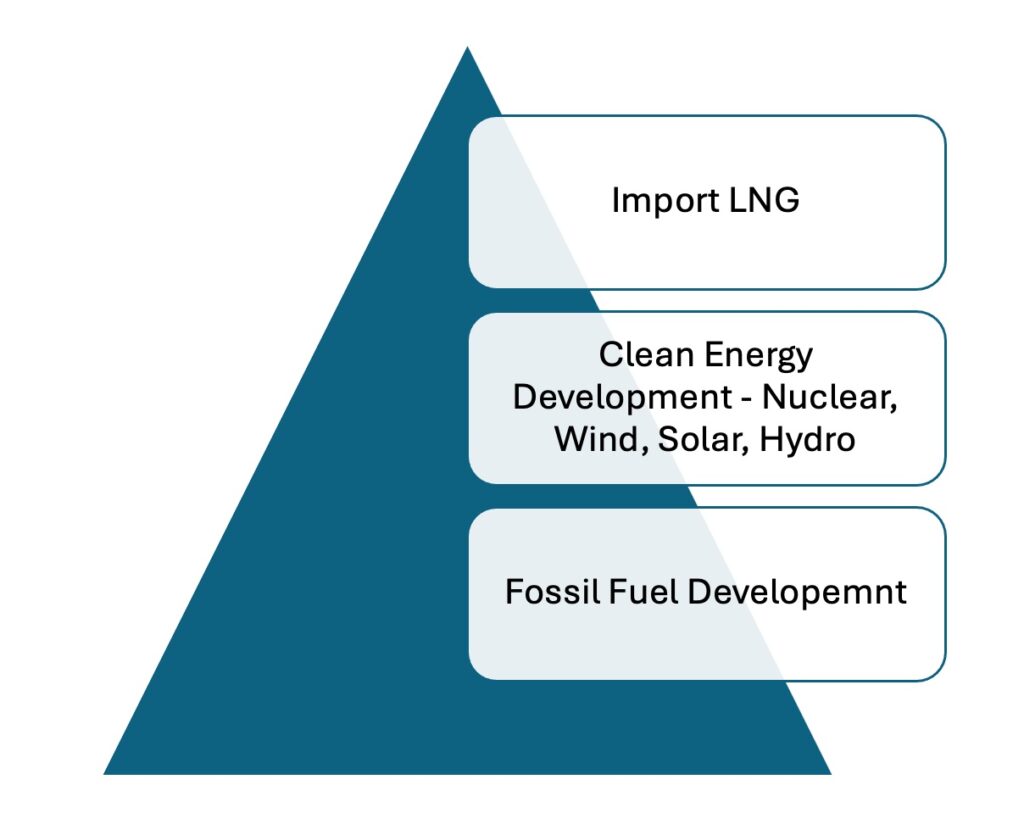

Alaskans need all options on the table as we weigh each one’s ability to deliver results for Railbelt consumers, especially given the critical timelines we face regarding gas supply.

ENSTAR, the Railbelt Utility Group, BRG, Cornerstone and other engineering firms have pooled their expertise to study these options and will soon release their final draft. The options outlined in their first draft will not change and these solutions make it clear that private sector intervention or state subsidies are needed to fill a large gap in gas supply.

BRG recently presented its study of gas supply options for Railbelt utilities to the Regulatory Commission of Alaska (RCA). An alarm bell sounded in April 2022, when Hilcorp stated that they were not going to contract for gas supplies beyond their current commitments.

Option A: Drill in Cook Inlet

The best option for the State and Alaska is to drill in search of new gas reserves in the Cook Inlet. The reality is that Hilcorp is the predominant supplier in the Inlet and if they do not see the economics of the Cook Inlet gas market going forward, then who will? Other major producers don’t see immediate incentive to drill, otherwise they would be doing so here rather than drilling in more complicated jurisdictions.

Alaska must turn to the smaller independents in the Inlet, but what will it take to stimulate sizable production and bring it online within the next 10 years? Maybe two off- shore platforms and drilling success at a price tag of $1.5+ Billion. This is capital the independents likely don’t have.

Option B: Import LNG

Using imported LNG makes total sense for Alaska’s Railbelt as a bridge solution until we have either a pipeline, new gas discoveries or other reliable alternative energy sources online. LNG today from Fortis BC is about 1/3rd the cost of Cook Inlet gas. Granted there are the transportation and storage components that will significantly increase the delivered cost of LNG for the Railbelt, but options for supply from Canada and elsewhere are available at fixed, long-term contracts.

This import option is economically viable today until exploration and development in Cook Inlet produces ratable gas supply for the utilities. LNG can continue to keep the lights on and the homes warm in the near-term and can be used for peak winter demand in the future to avoid what could be a disaster for Alaskans if we have an extended cold snap like we just had with waning LNG supply. LNG can be that interim solution as we transition to more renewable clean energy solutions, when they are available at scale and an affordable pricing, without jeopardizing the quality of life and energy security we have come to expect in Southcentral.

The former Conoco Phillips LNG plant, now owned by Marathon/ Trans-Foreland Pipeline Company, LLC has filed with DOE and FERC a request to turn the facility into an import terminal. On August 16, 2022, the Federal Energy Regulatory Commission (FERC) approved a request from Trans-Foreland Pipeline Company LLC to extend the completion of its Alaska LNG import project to December 2025.

FERC first approved Trans-Foreland’s request to build the plant in December 2020, and gave the company until December 2022 to place it into service. In July 2022, Trans-Foreland stated that uncertainty and volatility in the global LNG market had made it difficult to secure a suitable supply arrangement.

What we are witnessing here is delay and lack of urgency by Trans Foreland on a critical component to achieve gas supply security for Alaska. Expediting the re-positioning of the existing storage and marine facilities is the best solution. As a publicly traded company, Marathon should focus on their shareholders and develop projects with the greatest benefit and return. As Alaskans, we can ask them to open the facility for a “tolling arrangement,”. The state or the utilities need to make a suitable commercial arrangement that will get the gas coming into the state to supplement and shore up our energy requirements.

Globally, LNG has been a lifesaver. Imported LNG after the Fukushima incident in Japan replaced nuclear generation from shuttered plants, Similarly, when war in Ukraine cut off Europe’s gas supplies from Russia, LNG shipments from the global markets filled the gap. Now European countries and others have planned LNG into their energy mix, providing a bridge as they transition to clean energy, such as nuclear, solar and wind.

If we cannot use the existing Trans Foreland/Marathon facility, let’s move quickly to identify an alternate location and build onshore storage and re-gasification facilities with new cost competitive technologies. Floating storage and regas is another option, but there may be more difficult permitting and cost considerations. It is evident after the weather in 2024 that “we need to act now.”

Now is the time to take decisive action to secure our energy independence and security for Alaskans. Imported LNG is the perfect bridge to a clean, secure, energy future and is the only near-term solution for Southcentral.

Mary Ann Pease is the owner of MAP Consulting LLC, an energy consulting firm specializing in Alaska, Arctic, Pacific Northwest and international energy markets.