In a bid to address perceived State of Alaska employment vacancy and retention issues, the House Democrat-led majority has introduced House Bill 78, a pension reform measure they claim is a middle ground between past defined benefit retirement plans and the current defined contribution system.

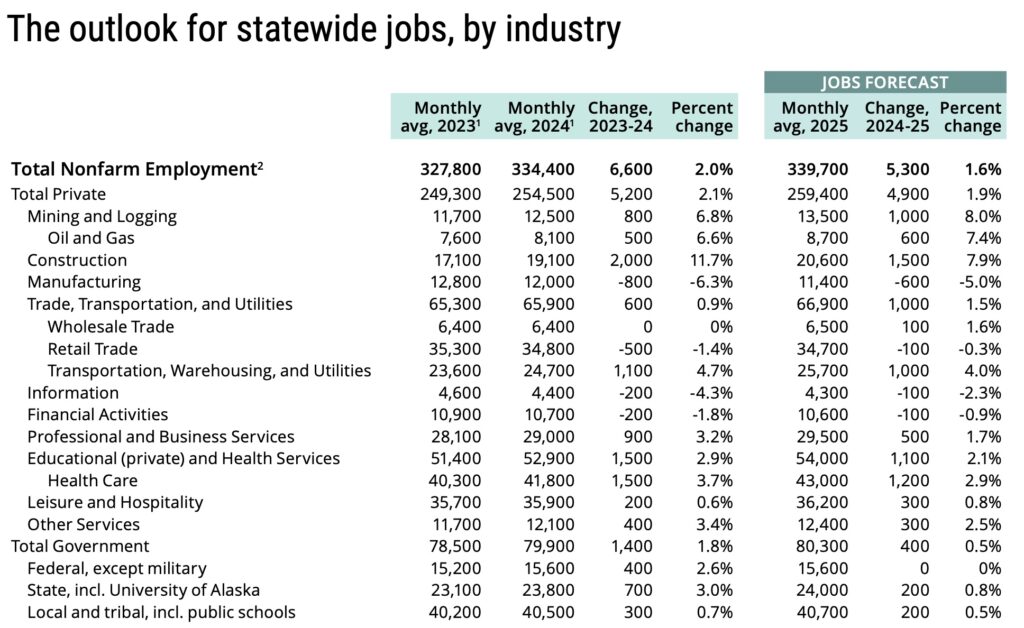

In reality, the State of Alaska added 700 people to its roster last year and is projected to be staffed by 24,000 workers in 2025. It remains one of the biggest employers in the state.

Yet the perception of needing a lavish pension plan, as was used in the 1970s to attract workers to Alaska, persists despite the evidence it’s not needed.

The House Finance Committee bill proposes a risk-sharing retirement model where responsibility is distributed among employers, employees, and retirees. This marks a departure from traditional defined benefit plans—where the employer bears most of the financial risk—and the existing defined contribution plan, which places the burden largely on employees.

Read more about HB 78 at this link.

The House Finance Committee is co-chaired by Democrats Neal Foster, Andy Josephson, and shape-shifting Cal Schrage, who claims to be an independent.

“It is time to act. Firefighters, law enforcement officers, teachers, and other state employees have been calling out for a change to our broken retirement system for years,” said House Speaker Bryce Edgmon, formerly a Democrat but now independent as a matter of political convenience, which allows him to switch back and forth between political alliances. “This bill presents an opportunity to finally have an honest discussion in the legislature, and with the public, that has been stifled for too long. With House Bill 78, Alaska has a real opportunity to make our state a competitive employer again.” (*Italics by Must Read Alaska)

House Majority Leader Chuck Kopp, a Republican who has joined forces with the Democrats to create a Democrat-controlled majority, said, “HB 78 will be considered with an eye toward a safer, more attractive, and orderly state that provides stability to businesses and families when making decisions to invest in Alaska.”

Representative Neal Foster, the Democrat co-chair of the House Finance Committee, explained, “HB 78 is about responsible retirement security that will not burden future generations of Alaska with unreasonable debt, and will make sure our workforce has reason to stay in Alaska.”

Are public employee defined benefit pension plans sustainable?

While HB 78 proponents say this bill will strike a balance, critics argue that any return to elements of a defined benefits system could create long-term financial liabilities for the state.

Defined benefit pensions, where employees are guaranteed a specific retirement income, have led to significant underfunded pension obligations in all the states where it has been used in the past.

In Alaska, the $7 billion still owed to the previous pension plan, dissolved in 2006, amounts to $9,524 per Alaskan owed to the pensioners still drawing from it.

The issue of growing unfunded obligations stems from a combination of factors, including longer life expectancies, inaccurate actuarial projections, and economic downturns that shrink investment returns. When these systems fall short, taxpayers will have to cover the gap.

Economists say the State of Alaska is uniquely at risk in these employer-guarantied pension schemes because the Alaska Constitution guarantees existing public employee pensions must be paid, as a much higher commitment than the need to plow roads, pay a Permanent Fund dividend, or even fund the University of Alaska. Article XII, Section 7 says public employee retirement benefits are contractual and cannot be diminished or impaired.

Now that the buying power of the Alaska Permanent Fund has failed to grow for some time and the Permanent Fund dividend has been skimmed off in order to increased state spending, public employee unions have the remaining Permanent Fund balance in their sights.

While the corpus of the Permanent Fund is protected in many ways, HB 78 does not protect it because of the Constitutional provision that says any retirement benefits must be paid.

HB 78 also does not acknowledge the congressionally passed Social Security Fairness Act, which was signed into law earlier this year. Alaska public employees benefit from this new law more than those of any other state. State and municipal employees, and retirees, in Alaska, including teachers and firefighters now have the entire Social Security entitlement for the first time since 1977. Therefore Social Security becomes for them a fully funded defined benefit retirement system, a very progressive one at that, in addition to the PERS and TRS defined contribution retirement systems.

PERS and TRS defined contribution systems are 401(k)-type plans that are more generous than most offered by private sector employers in Alaska. Supporters of the defined contribution systems, now almost 20 years old, point out that it has much more portability than defined benefit pensions.

Alaska moved away from defined-benefit pensions in 2006 due to the escalating costs of funding retirement obligations and price shocks not foreseen by actuaries of earlier years.

Defined contribution plans shifted more of the responsibility to employees, but also have contributions from the state. Yet they reduce the state’s financial exposure.

HB 78 is complex, as are all public pension systems. The bill is 52 pages of jargon, equations, and moving parts. No one would be ready to fully explain it upon a first reading.

However, one of the main flaws of the the bill is that it suffers from what’s known as adverse selection. It allows people to pick and choose how much the employer — the State of Alaska and local taxpayers — will be on the hook.

Also, the bill does not address problems unique to Alaska, such as the state taking on the majority of the responsibilities of the employer for municipalities and school districts that are not supported by property taxes. Those employers make decisions costly to the system and those costs are shifted to the State treasury and the Permanent Fund Earnings Reserve Account.

Public sector pension obligations are a growing issue across the United States, with several states grappling with severe pension funding crises, even though all states have discontinued these costly programs. Illinois, California, and New Jersey serve as cautionary tales, where massive unfunded liabilities have strained state budgets, forcing cuts to essential services and leading to tax increases to cover pension shortfalls.

Any sustainable retirement system must carefully balance benefits with fiscal responsibility. While HB 78 aims to mitigate risk through a shared model, fiscal conservatives warn that any system that shifts responsibility back to the employer could create financial obligations for future generations. If investment projections fall short or demographic trends change, taxpayers could once again be on the hook for shortfalls, undermining the bill’s goal of long-term sustainability.

HB 78’s destiny is uncertain as already there is another bill on the Senate side to bring back defined benefits at a time when billions of dollars are still owed to retired workers who were part of the old pension plan.

The bills in the House and the Senate would benefit elected officials at many levels, including legislators and staffers, and of course the executive branch at all levels.

There’s a general sense in Juneau that the House and Senate majorities have the numbers to enact a defined benefit retirement bill for public employees this session. The Department of Administration, which houses Retirement & Benefits, has been told to remain neutral on this financially critical matter. Since state finances are already so overdrawn and bleak, it’s likely that Gov. Mike Dunleavy will veto anything that brings additional financial uncertainty and budget stress.