SINCE A YEAR AGO, HIS PLAN TO BORROW HAD DOUBLED FROM $1.6 BILLION TO $3.3 BILLION

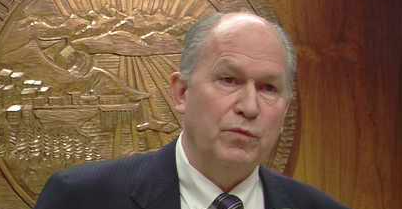

Governor Bill Walker has backed out of his unilateral move to sell bonds in order to pay off Alaska’s enormous pension obligation. He earlier this month had met with members of the Senate Finance committee, where he faced stiff headwinds.

“Given their lack of support, I have decided not to proceed with the issuance at this time,” Walker said. “Building a collaborative relationship with the Legislature will be necessary to reach our primary goal, which is a long-term fiscal plan for our state.”

Six weeks ago, the governor wrote to lawmakers that he would, with or without the Legislature’s input, borrow up to $3.3 billion to reduce the obligation the state pays into the various pension funds for state workers (PERS) and teachers (TRS) every year.

Alaska’s pension obligation for this fiscal year is about $340 million for PERS ad $116 million for TRS, short of one-half billion dollars.

The plan was to borrow money at a low rate and invest it for higher returns, using the proceeds to pay the pension obligations. That plan was predicated on earning 8 percent on investments, while only paying less than 4 percent on the bond interest payments. It might have earned the state $1.756 billion, but it could also lose money if the markets tank.

In September, Walker wrote that “Concern around market timing and the impact of delay on maximizing the benefits of this type of transaction is one of the reasons the legislature provided the administration in AS37.15.900 to AS37.16.900 with the authority to sell up to $5 billion in bonds.”

The market, some fear, is prone to instability since it is hovering at an all-time high.

Recently the rating agencies have signaled that such a loan would again lower the state’s credit rating. Moody’s had assigned the bond a AA2 rating, which is its fourth highest rating, making it a fairly stable investment. But the state’s overall creditworthiness could have been downgraded, making it more expensive for the state and municipal entities to borrow money.

While not acknowledging the market’s disapproval, Walker wrote today: “While we believe the financial benefits of issuing state pension obligation bonds significantly outweigh the financial risks, we recognize the need for legislative input.”

POBs, as they’re called, are a gamble. The payments are smoothed out across time, but they allow municipalities and states to not trim their budgets, and continue spending beyond their means.

The worst underfunded state pensions are: Alaska, Hawaii, Illinois, Connecticut, Massachusetts and New Hampshire.

Walker first floated the idea of borrowing-and-investing a year ago in November, announcing he would explore a $1.6 billion POB. Before the end of 2015, he had increased the number to $2.6 billion. By September of this year, he had ratcheted it to $3.3 billion.

Today, the idea has been put to rest until he can repair trust with the Legislature, an endeavor that may have now gained some traction with lawmakers.