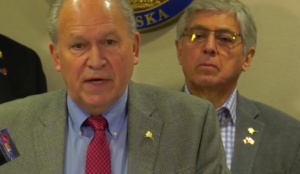

Gov. Bill Walker has given the first hint about how he intends to get more revenue for the State of Alaska during the Oct. 23 special session: It’s an income tax. Again. The Walker Administration claims it’s not an income tax, but rather a payroll tax.

Not an income tax, but tax based on income?

Walker was opposed to an income tax when he was running for governor, but has advocated for one ever since taking office. His 2016 proposal would have brought in $200 million of taxes from working Alaskans, and would grow state government by 60 new revenue agents. Alaska’s very own IRS.

By 2017, his plan had grown to nearly $800 million. And he’s offered several other revenue targets in a half dozen proposals his administration has put forward.

This one is Walker’s Goldilocks version, pulling in $300 million to fill the gap, whatever that gap may be.

Walker is hoping, like Goldilock’s third bowl of porridge, this time it’s “just right.”

The Walker tax would skim 1.5 percent off of wage earners, which would be capped once income reaches $150,000. The top-end taxpayers would pay $2,200 to the Department of Revenue to raise cash for the government.

Today’s reveal of the income tax came in the official proclamation for the special session, which includes criminal justice reform measures. The governor’s office distributed the packet for the tax bill this afternoon. Must Read Alaska has not seen the details yet.

The Democrat-led House majority favors an income tax, but the Senate Republican majority is still dead set against one, according to Sen. President Pete Kelly of Fairbanks.

“The Senate Majority supports a special session in October to address crime. Alaskans have legitimate concerns about our laws holding offenders accountable,” said Sen. Kelly in a statement. “The Senate already passed the legislation, SB 54, toughening penalties for certain crimes. We offer our support to the House to do the same, and stand by to work out any differences. Alaskans should feel safe in their homes and communities, and it is incumbent upon the Legislature to do our part to ensure criminals face consequences.”

“The Senate Majority welcomes additional discussion on the state’s fiscal problems, which we believe are best addressed by reducing government budgets and instituting a spending limit. We have asked the administration, before new taxes on working Alaskans are considered, to provide a budget for the coming fiscal year that includes reductions in spending, and a revised revenue forecast with responsible estimates of oil price and production,” he said.

“With this information in hand, the Senate will be able to accurately determine what, if any, actions must be taken to raise additional revenue from Alaskans. We want to make it clear that any ‘complete plan’ to address our fiscal problem cannot solely reach into Alaskans’ pockets for more government money, but must include budget reductions. Government has to do its part,” Kelly said.

His position was echoed by the Senate Majority Leader Peter Micciche today.

“Until the Senate is convinced that there is a gap over the long term, and when both sides agree on the range of the gap, we will continue to protect working Alaskans from taxes that unnecessarily overcapitalize this government,” said Micciche, of Soldotna.

“Our request to the administration was to very publicly and transparently meet in Anchorage in a work session, including people on both sides of the aisle, to clarify why they believe our numbers are incorrect, and to agree on a range going forward.”

Micciche said a work session rather than a special session would save the state per diem. It would give the governor the opportunity to have his team present their case in a place where many Alaskans could get to hear both sides. The Senate majority is also asking for updated revenue numbers from the Administration to better evaluate the actual fiscal gap.