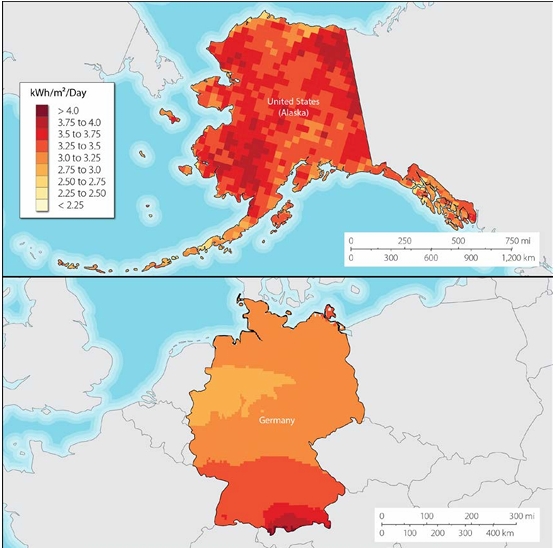

As Alaska grapples with high diesel costs in remote villages and eyes solar power to diversify its oil-dependent economy, experts are urging caution by pointing to Germany’s energy transition (Energiewende) as a multi-billion-dollar cautionary tale. A 2015 U.S. Department of Energy (DOE) report once touted Germany’s solar success as a benchmark for Alaska, highlighting comparable insolation levels to argue for viability despite harsh latitudes. But a decade later, Germany’s transition has ballooned into a multi-trillion-euro burden, raising alarms for cash-strapped Alaska.

While similarities exist—both face low sunlight and fossil fuel reliance—differences underscore the risks. Alaska’s seasonal solar variability, snow losses, and logistical hurdles inflate PV costs 2–4 times U.S. averages, mirroring Germany’s grid bottlenecks and subsidy traps. Germany’s installed capacity has surged to over 112 GW, but at what price? Forecasts now peg total transition costs at up to 5.4 trillion euros by 2049, including 440 billion euros for grid upgrades and 2.8 billion euros in annual “redispatch” payments to idle renewables. High electricity prices—double U.S. rates—have sparked de-industrialization, companies leaving, and public backlash, with household bills doubling and GDP growth lagging 0.5–1% annually.

The DOE’s assumptions amplify the warning: It relied on outdated insolation data (1980s-era), optimistic LCOE estimates (40–129 cents/kWh for solar vs. diesel), federal incentives like 30% tax credits, and low-penetration integration ignoring storage needs or seasonal mismatches. These overlook non-fuel diesel costs, full grid upgrades, and subsidy distortions like Alaska’s Power Cost Equalization program, which could erode incentives. Germany’s experience shows how such assumptions underestimated locked-in subsidies (16 billion euros in 2024 alone) and economic drags, leading to “buyer’s remorse.”

For Alaska, whose $50 billion GDP hinges on oil, mimicking this could hike utility rates roughly 20–50% short-term to include infrastructure costs for integration and exacerbate budget strains amid low oil prices. “With the current policy, the energy transition cannot succeed. It risks driving energy-intensive industries abroad while weakening Germany’s economic base,” warned DIHK President Peter Adrian.

Renewable advocates say Alaska’s vast potential remains untapped at just 33 MW installed, but without reevaluating assumptions, the transition could mirror Germany’s pitfalls rather than its promises. The irony of the German energy transition is that instead of reversing course to reliable and affordable power sources, policy makers are doubling down on research for ways to reduce the cost of the transition to mitigate their contribution to global climate change. In the end, the citizens are sacrificed to the quest for climate neutrality.