The Biden Administration’s Federal Trade Commission has sued over the merger of two of the nation’s large grocery retailers — Albertsons, which owns Safeway; and Kroger, which owns Fred Meyer stores.

The proposed deal is the largest supermarket merger in U.S. history.

“This supermarket mega-merger comes as American consumers have seen the cost of groceries rise steadily over the past few years,” the FTC Bureau of Competition said in a statement. “Kroger’s acquisition of Albertsons would lead to additional grocery price hikes for everyday goods, further exacerbating the financial strain consumers across the country face today.”

Joining the lawsuit were attorneys general from Arizona, California, Illinois, Maryland, Nevada, New Mexico, Oregon, Wyoming, and the District of Columbia.

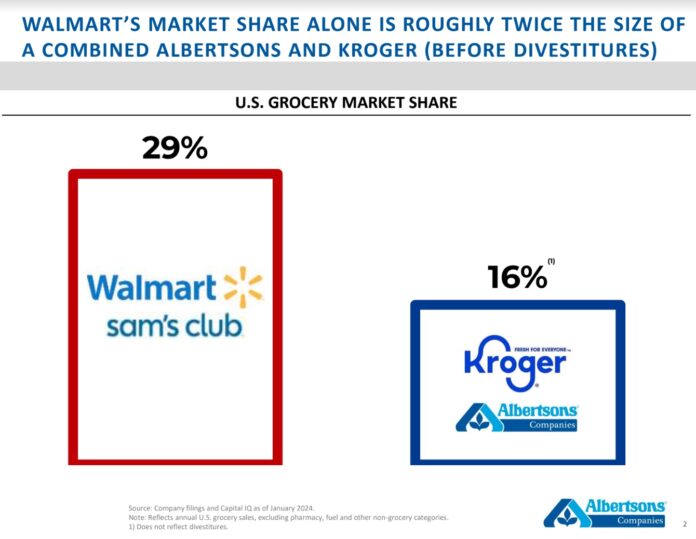

An Albertsons spokesperson said that by trying to block the merger, the FTC is giving more power to Amazon, Walmart, and Costco.

“Albertsons Cos. merging with Kroger will expand competition, lower prices, increase associate wages, protect union jobs, and enhance customers’ shopping experience. If the Federal Trade Commission is successful in blocking this merger, it would be hurting customers and helping strengthen larger, multi-channel retailers such as Amazon, Walmart and Costco – the very companies the FTC claims to be reining in – by allowing them to continue increasing their growing dominance of the grocery industry,” the spokesperson said. “In contrast, Albertsons Cos.’ merger with Kroger will ensure our neighborhood supermarkets can better compete with these mega retailers, all while benefitting our customers, associates, and communities. We are disappointed that the FTC continues to use the same outdated view of the U.S. grocery industry it used 20 years ago, and we look forward to presenting our arguments in Court.”

Disappointing that Alaska did not join the lawsuit

Why?

Frank just falls in line lockstep with what the talking heads on the glowing screen tell him he needs to believe.

Frank won’t be able to give you a reason for why Alaska should have joined the lawsuit.

Too bad the argument for the merger is “FTC is giving more power to Amazon, Walmart, and Costco”.

We always knew Walmart was powered by trade relations with China interests. I know nothing about Costco, but Amazon is big for its britches, with interests in all aspects of product delivery; from transportation of orders to the consumer, banking, localized warehouses, labor disputes, and the products themselves i.e. pharmaceuticals, mass-produced goods to one-of-a-kind products.

I don’t know what triggers the ads, but I get them all the time from Temu which sounds like a Chinese version of Amazon. From the Business Bureaus website: “It appears Temu is an online marketplace and the company name is WhaleCo, Inc. which is registered in Massachusetts as a Foreign Corporation through Delaware. It appears items ordered are typically directly shipped from Temu’s suppliers globally, including China.”

A lot of folks latch onto the word ‘globalist’ and ‘global’ and express disdain for globalism, supporting the short-sighted trumphian tariff strategies.

There is doubt of higher domestic production and less dependence on American drugs re-imported to the USA. It seems to me imports are the majority of goods filling shelves at Walmart, and at Amazon. The effect of next-day delivery of Amazon products has subsequently affected US Post Office services. Kroger brands feature frozen food products from fish, to fruits, even canned apricots from China, but that’s been going on for more than a decade.

And, now, more greed with a mega-merger and monopolization of grocery suppliers. I’d think folks would be a mite upset about the little difference between super, supermarkets and a state-run grocery.

The only way a Safeway/FM merger would be “more competitive” is by them closing stores and reducing competition. There is a reason why Walmart, Amazon, and Costco have larger market share and are gaining: Fred Meyer prices average 20% higher than Costco and 18% higher than Walmart, and Safeway prices are only slightly less than Fred’s – at least on the items I typically buy. Closing stores would allow the corporation to raise prices further while cutting expenses – good for the stockholders until they go bankrupt, but an instant disaster for consumers. I prefer to let market forces be as unimpeded as possible – but this level of greed renders this merger impossible for the free market to be free. BTW, notice that there are large amounts of bare shelf space? Or that product selection is being reduced? Kroger, if you want my vote and my business, COMPETE and stop with the whining and the gimmicks.

Any time the government interferes in the free commerce of companies, it has resulted in higher costs to the consumer. Every time, from Standard Oil to Ma Bell, the ratepayer gets screwed. If the idiots on here want to buy a grocery chain and compete with Walmart, go for it. Trying to compare Costco or Amazon with Fred Meyer is pure idiocy. There is no comparison to the services supplied between those entities. Go into Costco and buy a package of mustard or ketchup that isn’t huge. Do it in 10 minutes. Get Amazon to deliver a 1/2 gallon of ice cream. it is $90.00. The clue train has left you at the station if you are making these idiotic arguments against the merger.

When you have DC in on the lawsuit, you know that the merger really should happen. I wonder what is going on that we do not know about?

Glad to see that our Congressional delegation did something. Wonder why Mike and Trig didn’t chime out?

Comments are closed.