America’s fiscal outlook is on an unsustainable trajectory, with federal interest costs surging at an alarming rate, says the Peter G. Peterson Foundation, which tracks budgetary and other fiscal issues facing America.

According to new data from the Congressional Budget Office, rising debt and higher interest rates have significantly increased the cost of borrowing, putting immense pressure on the federal budget.

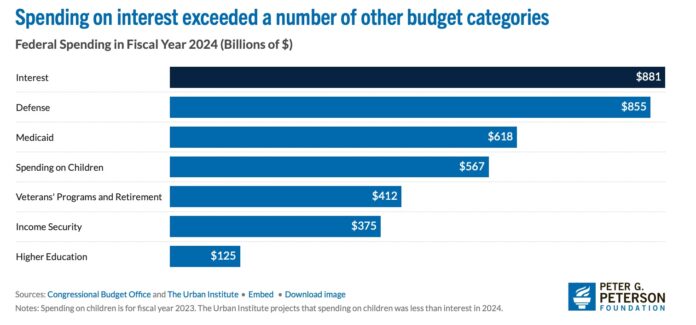

In 2024, the U.S. government paid $881 billion in interest on the national debt, a figure that surpasses most other federal budget components.

Projections indicate that interest costs will rise to $952 billion in 2025, an 8% increase from the prior year. This follows staggering increases of 30% and 32% in each of the two years before that under the Biden Administration.

The Treasury currently pays an average of $2.6 billion per day in interest alone. Without a change in fiscal policy, this number is expected to balloon to $4.9 billion daily by 2035, the foundation predicts.

Over the next decade, total interest payments on the national debt are projected to reach an unprecedented $13.8 trillion—nearly double the inflation-adjusted total from the past two decades combined.

To put $13.8 trillion into perspective:

- It equates to approximately $40,500 per U.S. resident.

- It is nearly twice what the government spent on net interest between 2005 and 2024.

- It is over four times the projected Social Security cash deficits in the next decade.

- It is nearly five times the cost of all U.S. weather and climate disasters exceeding $1 billion since 1980 (adjusted for inflation).

- It is more than 20 times the estimated $625 billion needed to overhaul America’s drinking water infrastructure over the next 20 years.

By nearly every measure, the foundation explains, interest costs are at historic highs and are set to climb further. Net interest costs under CBO’s projections are expected to reach nearly $1.8 trillion by 2035. Relative to the economy’s size, interest payments will account for 3.2% of gross domestic product by 2026, surpassing the previous record set in 1991, and will continue rising to 4.1% by 2035.

Additionally, federal interest payments as a share of revenue are set to hit 18.4% in 2024, tying the 1991 record. By 1993, President Bill Clinton began to earnestly work down federal spending. Via executive order, Clinton issued an executive order telling each government department or agency with more than 100 employees to cut at least 4% of its workforce.

In fact, he had budget surpluses 1998–2001, the only such years to have them since 1973. The Democrats in that era were onboard with Clinton.

While the 2025 interest on debt number is expected to decline slightly in the next two years, it will resume an upward trajectory, reaching 22.2% by 2035, the Peterson Foundation says. Interest costs will also constitute 15.6% of total federal spending by 2031, surpassing the previous peak of 15.4% set in 1996.

As more federal funds are funneled toward servicing debt, the government will face increasing difficulty in addressing pressing challenges and investing in the country’s future. The need for fiscal reform is urgent—without it, mounting interest payments will continue to drive higher debt, exacerbating financial instability and limiting the nation’s ability to respond to emergencies, invest in infrastructure, and support economic growth.

See more of the charts on this interest-on-debt situation at the Peter G. Peterson Foundation.