Rarely does a new state tax policy deliver such unambiguously positive results, so quickly.

But, the announcement yesterday that Repsol and Armstrong Oil have confirmed that their huge North Slope oil discovery is on the higher side of initial estimates is the latest indication that the More Alaska Production Act of 2014 (SB21) has been an unqualified, blockbuster success story.

Alaska voters can give themselves some hearty pats on the back for that — about 90,000 pats, in fact, which is the number of voters who voted no on the 2014 ballot initiative that sought to repeal SB21.

By ratifying SB21 in no uncertain terms, voters kept a policy in place that has delivered to Alaskans their first increases in pipeline throughput in over 15 years. Yesterday, those voters got the news that a major new find has been confirmed that could add a jaw-dropping 20 percent to Alaska output.

ARMSTRONG

Armstrong Oil and Gas is no stranger to Alaska oil tax whims, especially the efforts of left-wing legislators to treat the producers like their own political piggy banks.

Armstrong for two decades has been among the independent oil companies that, in a world of big oil, are the little engines that could.

President Bill Armstrong has hung in there through the tax mood swings of the disastrous “ACES” policy and its predecessor tax hikes, and was finally rewarded in 2014 when the More Alaska Production Act (MAPA, or SB21) was passed and ratified by voters.

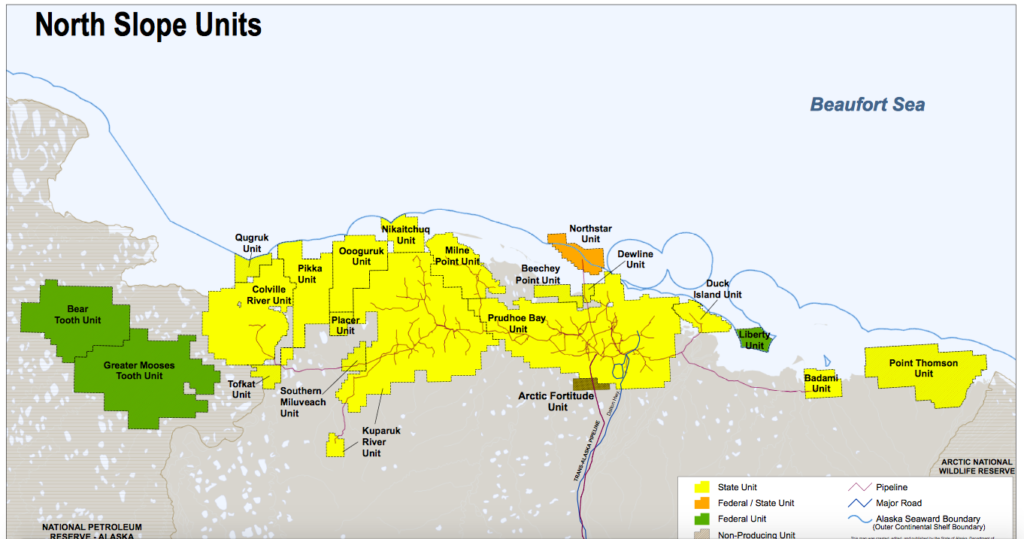

Today, Armstrong too can pat itself on the back. After joining forces with Repsol, Armstrong is now the proud majority stakeholder of a great set of holes at the Pikka prospect, which is described by the company as the largest North American find in 30 years.

Although it made headlines this week, this find has been in the trade journals since early fall. After drilling some additional delineation wells this winter, Armstrong and Repsol confirmed that the find is, indeed, a whopper.

With an estimated 1.2 billion barrels of recoverable oil, the Horseshoe-1 discovery well indicates more than 150 feet of net pay — a way of calculating the total from various holes — in several reservoir zones in the Nanushuk section. A sidetrack, Horseshoe-1A, found more than than 100 feet of net pay. Those are some sweet pay zones. Drilling took place during the 2016-2017 winter season.

Republican Alaska lawmakers and former Gov. Sean Parnell can also pat themselves on the back. They are the ones who put forward and passed the important tax reform legislation in 2014. The MAPA reforms modified some of the worst aspects of the old ACES taxation plan, which had made Alaska a very unattractive place to produce oil.

The proof of that lies in the sharp production declines that occurred year after year during the bad old days of the ACES era. ACES punished producers with extreme taxes when prices were high, although taxed less in a low-price environment.

The More Alaska Production Act (MAPA), as SB 21 was called, evened it out so the low-price years brought in more tax revenue, but when prices soared the severance tax rate was not as confiscatory.

That turned out to be a good thing because, shortly after SB 21 was passed, oil prices dropped like a rock. MAPA is now bringing in much more revenue than the old ACES system would have at today’s prices.

On top of that, production increased even at these lower prices, which is bringing in even more revenue than ACES.

This has helped Alaska limp through the painful economic adjustments brought on by too-big government and not enough revenue to pay for it.

“The North Slope project is representative of the new movement in Alaska where smaller independents work and operate in areas previously dominated by major oil companies. Armstrong has participated in 16 wildcat and appraisal wells on the North Slope in the last four years,” Armstrong told Oil & Gas 360 last year. “Every single well was successful, and a third-party engineering firm places total proven reserves at 497 MMBO in the region.”

Those reserve estimates just jumped markedly.

HARD FOUGHT TAX REFORM

ACES and MAPA had some things in common, including providing for tax credits to incentivize more exploration. Those credits led Repsol to drill in the Pikka area, where they and Armstrong have drilled 13 wells. First production is expected as soon as 2021, with a potential of 120,000 barrels of oil per day. That should warm up a cooling Trans Alaska Pipeline.

The repeal of ACES in favor of MAPA was a hard-fought battle. For example, Rep. Harriet Drummond, D-Anchorage, stood outside the bill-signing ceremony carrying a protest sign that read: “Corrupt Bastards Club – Third Floor.” The third floor of the Dena-ina Center is where Gov. Sean Parnell and Republican leaders were signing SB 21, and Drummond and a handful of Democrat protestors were having none of it.

Sen. Bill Wielechowski, D-Anchorage, also hated the legislation, writing in the Anchorage Daily News at the time that “SB 21 took us back to a failed policy we had in place for three decades and cost us hundreds of billions in lost revenue. We got nothing in exchange for this bill.”

Nothing, if you don’t count more revenue and more production.

Even today, the left-leaning majority in charge of the House of Representatives is trying to rewrite SB 21, with HB 111 being offered by Rep. Geran Tarr and Rep. Andy Josephson, Anchorage Democrats now infamous for telling the Alaska Center for the Environment last fall that they should use their official legislative offices as satellite offices for their environmental lobbying.

Tarr and Josephson want to increase taxes when prices are low, as they are now. But is that wise?

Roger Marks covered the topic at the Alaska Support Industry Alliance on Friday. His talk was titled, “Evaluation of HB 111: Allocating Misery of Low Prices.”

Marks told the breakfast meeting that, in its current form, HB 111 might exacerbate a flaw in the current tax system. He explained that while SB 21 may have stimulated exploration and production, the law shifts does shift the low price risk to industry taxpayers. HB 111 shifts it even more.

Marks also doesn’t think the cuts in production from OPEC countries are something Alaska can depend on to keep prices higher. Even as prices rise — and they eventually will — shale oil production will return in the Lower 48 and elsewhere. The technology of shale oil fields has been a game-changer.

Right now, companies have a hard time making money in Alaska, where the cost of doing business is high and taxes and royalties take a big bite. HB 111 increases the minimum tax from 4 percent to 5 percent of gross, and decreases the per-barrel credit from $8 to $5 at prices below $110 per barrel.

That 1 percent might raise the state another $37 million, but it might also act as a damper on production.

HB 111 also ends the state purchase of refundable credits, but producers can still carry the credits forward until they have income to offset them.

Putting future tax credits on hold might be necessary, since there is a shameful backlog of existing credit obligations that the governor has not paid to several companies. But the evidence is in that past tax credits, combined with sensible tax policy, are resulting in exciting new oil discoveries.

Now, if tax policy remains steady and bills like HB111 do not see the light of day, Alaska might even see production of that oil.