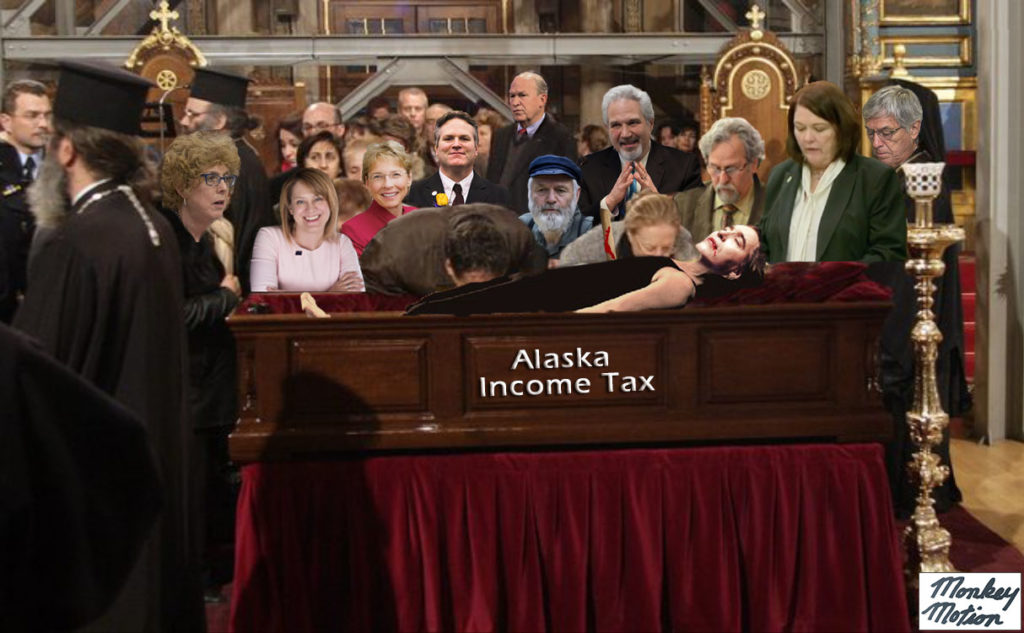

ANOTHER TAX COMING? Gov. Walker insisted it’s either an income tax or an income tax. His first tax, offered last year, would have raised $200 million a year, but would have required hiring up to 60 new revenue officers. His latest tax, HB 115, would have garnished closer to $700 million from wage earners. The fiscal note for funding tax collectors on that bill, which involves a complicated system of tax brackets, is unclear as it was voted down by the Senate.

Walker, for two years, has pursued an income tax, but has met with resistance. But this year there was a hitch — he didn’t offer an income tax under his own name. Not even for Special Session.

After all, that’s what Rep. Paul Seaton of Homer is for.

Walker also predicted, through Revenue Commissioner Randy Hoffbeck, that pipeline throughput oil will drop 12 percent next year. Yes, those were bad numbers, he admitted…”stale numbers.”

Then Commissioner Hoffbeck mysteriously found a spare $111 million in an oil production estimate. No word on where or how he found it, but that’s about half of what Walker’s first income tax bill would have provided.

Walker told Alaskans it’s math — workers need an income tax because of “the math.”

We did the math: 34 legislators are on record as disagreeing with the governor on income taxes. That 56 percent of legislators is on track with the Alaska Chamber of Commerce poll that found 58 percent of Alaskans feel the same way.

Is an income tax dead? In the infamous words of Rep. Gabrielle LeDoux, “If the Senate thinks they’re going to get out of here with just a POMV [Permanent Fund restructure], they’ve got another think coming.”

But in the infamous words of Sen. President Pete Kelly: “The only thing standing between Alaskans and an income tax is the Alaska Senate.”

ADDICTED TO TAXES? Alaska is one of seven states without an income tax. Connecticut started its income tax at 4 percent, but converted to six brackets of 3% to 6.7%. Now, the Nutmeg State has a bigger budget gap than ever, with the worst fiscal shape in the nation. Add to that this problem: The wealthy people are leaving. Will they raise taxes again? Alaskans should take heed.