BY KOBE RIZK

The Anchorage Economic Development Corporation released its annual 3-Year Outlook Report Wednesday in a star-studded lunch meeting at the Dena’ina Center in Anchorage.

It was a stark flip-flop from last year’s report, which stated that “a growing body of evidence indicates the recession is likely near its bottom and the local economy is poised for recovery.”

The AEDC previously anticipated that by this summer, Anchorage would be enjoying strong job growth, higher incomes, and a through-the-roof optimism score.

But according to AEDC, Anchorage’s Era of Good Feelings has come to a sudden end. All of this good news was thrown out the door. The reason? A $3,000 Permanent Fund dividend.

Gov. Michael Dunleavy’s vetoes of about $444 million from the state’s $8.7 billion operating budget—amounting to a total reduction of about 5 percent—will, according to the AEDC’s report, “promise to keep the local economy in recession”.

The governor’s reductions represent around 0.8 percent of Alaska’s $54 billion annual GDP, which the federal Bureau of Economic Analysis says grew over 3 percent in the past year.

Bill Popp, AEDC president and a former member of both the Gov. Bill Walker and Mayor Ethan Berkowitz transition teams, made the presentation.

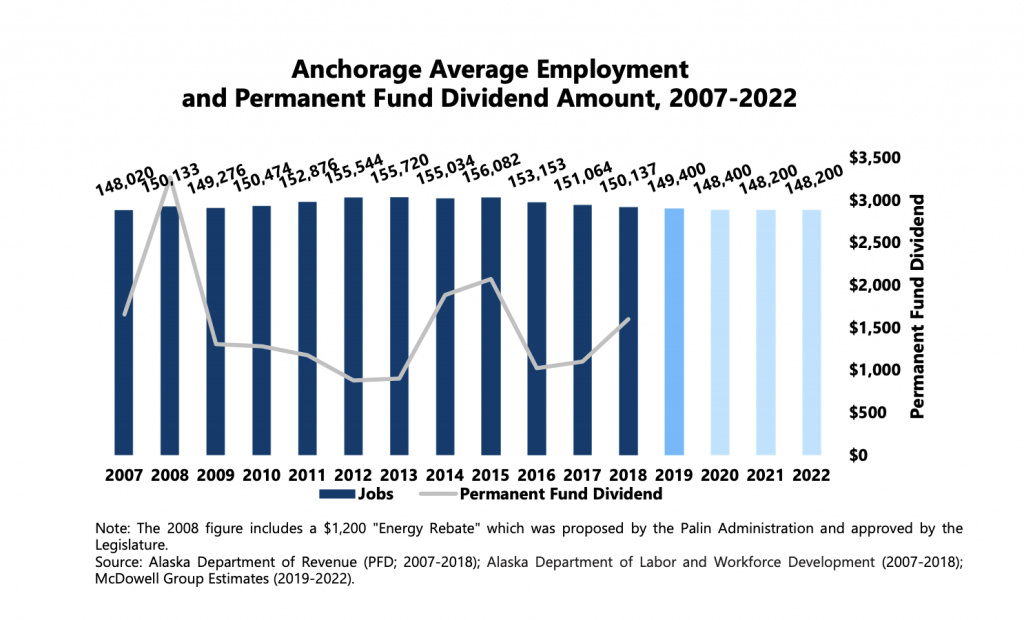

According to a graph never previously included in an AEDC’s annual outlook report, the Permanent Fund dividend has absolutely nothing to do with employment (as if anyone ever claimed that it did):

The message from AEDC was clear: Paying a full PFD, and the 5 percent budget reduction needed to do so, is the impetus for Alaska’s coming economic troubles.

“While a large PFD may provide an infusion of personal income, its short-term benefits from an economy-wide perspective will not compensate” for the apparent economic bleed-out that will result from Alaska’s modest budget reductions.

What’s more, the AEDC seems to have quite a different position on the PFD than it has had in past years.

Ten years ago, AEDC similarly claimed that Alaskans ought to prepare for a deep recession, and said smaller Permanent Fund dividends would slow the economy.

“It is anticipated that growth will slow in the next three years due to slower employment growth, decreasing returns from investments in the stock market, lower profits for local businesses, and smaller Permanent Fund Dividend payments,” according to the 2009 report.

The AEDC also showed pro-PFD sentiments two years ago when it stated that “the annual Permanent Fund Dividend payment is typically one of the largest government transfers Anchorage residents receive each year. In 2016, the $1,022 payment was worth nearly $300 million to residents.”

If this was true three years ago, would a $3,000 PFD contribute three times that amount to Anchorage today? Would $900 million for one city outweigh the $444 million statewide in budget vetoes this year?