A new, bipartisan Alaska Gasline Caucus, co-chaired by Rep. Mia Costello (R-Anchorage) and Rep. George Rauscher (R-Sutton), met for the first time yesterday to assess Alaska’s readiness for the proposed 800-mile Alaska LNG pipeline. The inaugural meeting in Anchorage featured presentations from Glenfarne Alaska LNG, the state Department of Labor and Workforce Development, and the University of Alaska, and was attended by over 20 legislators in person or via livestream.

Glenfarne, University, and State Leaders Weigh-In

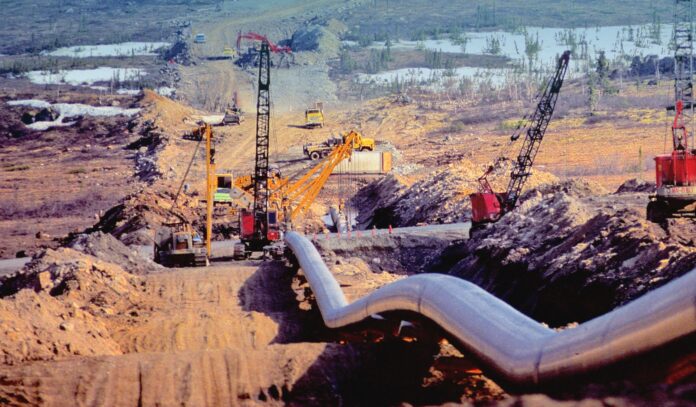

Glenfarne President Adam Prestidge highlighted the pipeline’s alignment with the existing Trans-Alaska oil pipeline route for efficiency, describing it as the most engineered pipeline project to-date, with construction (“pipe rolling”) slated for mid-2026. The initiative is projected to create 12,000 jobs in Alaska. If approved, the Alaska LNG project will be one of the largest infrastructure projects on the planet.

University officials, including Interim Dean Kevin Alexander of the University of Alaska Fairbanks Community & Technical College, reported near-capacity enrollment in construction-related programs, with certification pathways, but stressed a supply-demand imbalance for skilled workers.

Labor Commissioner Cathy Munoz outlined regulatory reforms to recognize out-of-state occupational licenses, retention strategies for military personnel, and updates to the statewide gas line workforce plan, with enhanced training capacity. Further details will follow legislative sessions in January.

Co-chairs Costello and Rauscher emphasized inter-agency accountability, free-flowing ideas, and legislative support to prioritize Alaskan benefits, while acknowledging ongoing questions as the project progresses. The caucus aims to ensure comprehensive state readiness for this “historic opportunity.”

“This project will bring tremendous opportunity to the state,” Costello said. “We are going to be asking all state departments ‘What have you done? What are you doing now, and what are you planning to do?’ We will be having many meetings, and we want to keep the ideas free flowing.”

The Phases, Major Partnerships, and Glenfarne’s Final Investment Decision

Glenfarne Group, LLC, solidified its role as the lead developer of the Alaska LNG project in March 2025, acquiring a 75% stake in collaboration with the Alaska Gasline Development Corporation (AGDC), which retains 25%. The 42-inch-diameter natural gas pipeline leverages existing infrastructure by paralleling much of the Trans-Alaska Pipeline System route.

The pipeline is designed for phased implementation to address both domestic and export demands. Phase One focuses on a 765-mile segment extending to the Anchorage area, aiming to mitigate perceived natural gas shortages in the Cook Inlet region, where production has plummeted.

Phase Two would extend the pipeline under Cook Inlet to a state-of-the-art 20 million tonnes per annum (MTPA) LNG export terminal in Nikiski, positioning Alaska to supply liquefied natural gas to high-demand Asian markets.

To drive economic feasibility, Glenfarne claims it has secured offtake agreements with major players, including Japan’s JERA for up to 4 MTPA, South Korea’s POSCO (which also commits to supplying steel for construction), and Thailand’s PTT. Engineering partnerships, notably with Worley, have refined designs, while expressions of interest from strategic partners exceed $115 billion in total, according to reports.

Glenfarne expects a final investment decision (FID) for the pipeline by late 2025, with full project FID in 2026, and construction commencing mid-2026. Peak construction is estimated to produce 12,000 jobs. Overall, the initiative represents a transformative infrastructure project with the promise to revitalize Alaska’s resource-based economy and to create a stable source of energy for consumers.

Questions and Concerns

With energy strategy shifting to North Slope gas in lieu of Cook Inlet gas, some southcentral consumers are wondering what will happen to Cook Inlet producers such as Hilcorp, Furie, and Bluecrest Energy. Similarly, railbelt utilities want assurances that connection agreements can be secured with 8-Star LLC to off-take natural gas adequate to outpace the supposed supply gap in Cook Inlet.

My instincts tell me that the comment period has been hanging out there in the wind and no planners doing their jobs. No legal notices, no discussion with the residents of the state but a lot of paper and ink passing in the night. Where have all the legal notices gone? I haven’t seen one nor has the planners mentioned in this article stepped forward to follow the law.

Bring to the public’s attention when the comment period begins for each of the projects as well as time for communities to respond to who should be building and where it should be built. Let’s look at the legitimacy of the pipeline and where it will be built. That isa a resource of Alaska and for the benefit of Alaska first and foremost.

Everyone wants more money to live a more joyful life. If the money is in the ground, why leave it there?

Drill Baby Drill.

Alaskans are smart to want to supply our friends with energy instead of having them buy it from our enemies, and making more money for them instead of Americans!