PUBLISHER GAVE CREDITORS ULTIMATUM; THEN FLEW OFF TO ICELAND

The lawyers for Alice Rogoff really wanted to settle with creditors last fall, and on her behalf they were seeking deep discounts in the amounts Rogoff and/or the Alaska Dispatch News owed to unsecured creditors. Court filings show her lawyers leaning heavily on small businesses to cut a deal, or be prepared to get nothing from Rogoff.

The former owner of the Dispatch (since sold and renamed Anchorage Daily News) owed as much as $33.5 million to both secured and unsecured creditors, and declared herself to be among the first in line to be paid — saying the bankrupt businesses she owned owed her $23.6 million.

Arctic Partners, from whom she had leased a building, wanted $3.4 million. GCI wanted $2.5 million. And M&M Wiring wanted $668,000.

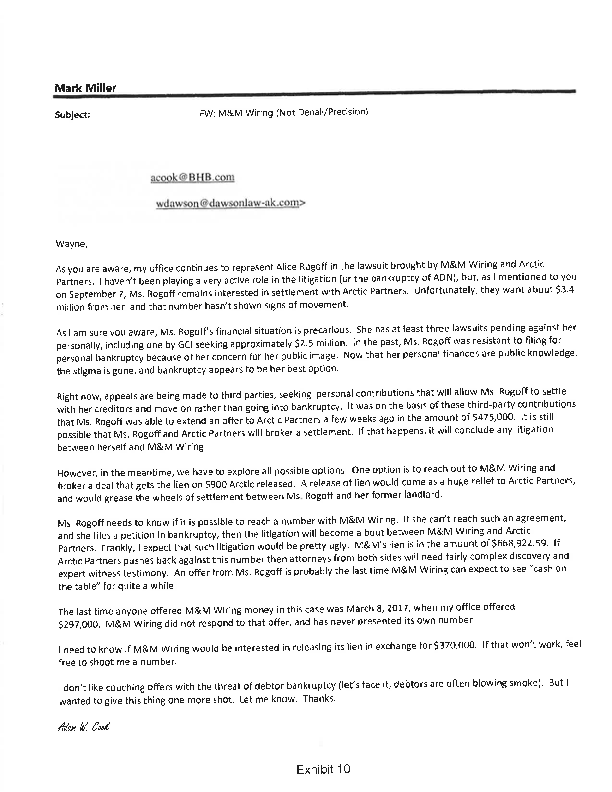

According to documents filed with the court, the law firm of Birch Horton Bittner & Cherot reached out to the lawyers representing both Arctic Partners and M&M Wiring, looking for deals.

To M&M Wiring’s attorney Wayne Dawson in October, Birch Horton law partner Adam Cook wrote “As I am sure you are aware, Ms. Rogoff’s financial situation is precarious. She has at least three lawsuits pending against her personally, including one by GCI seeking approximately $2.5 million. In the past, Ms. Rogoff was a resistant to filing for personal bankruptcy because of her concern for her public image.”

It sounds like a reasonable overture: Everyone is concerned about his/her image, no one wants to file personal bankruptcy, and Alice had a lot going on in her life — three personal lawsuits, to begin with.

The public image she was likely most worried about in October, 2017 included her reputation on the international stage, and the future of a small publishing business she had kept going after selling the Dispatch.

Rogoff in October was speaking at the Arctic Circle Assembly in Reykjavik, Iceland, where she would no longer appear as the publisher of the Dispatch, but as the owner of “Arctic Today,” the online publication she was able to take with her during bankruptcy proceedings of the previous weeks. It’s a product the Dispatch had launched many months earlier as “Arctic Now,” and by now she had renamed and relaunched it as a Delaware Corporation.

Rogoff was advisory board chair for the Arctic Circle Assembly, where she would introduce Sen. Lisa Murkowski and hobnob with Arctic knowledge experts and leaders. Personal bankruptcy would have tarnished that carefully cultivated brand of polar expert, intellectual, art patron, and adventuress.

Her public image also mattered in October because, while going through a multi-business bankruptcy and relaunching Arctic Now, she was in the middle of a divorce from her now-ex husband, David Rubenstein.

She needed money from Rubenstein. It would have been far more comfortable for her had she been able to zero out some of her biggest troubled debts and move on.

During the private divorce negotiations, Rubenstein’s attorneys likely had some sideboards on his financial arrangements. Rubenstein wanted the details of the divorce settlement to be kept private, for one. But were payments made before the divorce? As the fabulously wealthy cofounder of the Carlyle Group of private equity investors, her husband would be the ultimate deep pocket.

Rogoff knew that at some point in the very near future, her divorce would splash across the pages of the Washington Post. Again, personal bankruptcy would be a difficult narrative to explain to the Washington Post.

A THREAT OF PERSONAL BANKRUPTCY

But while that was going on in Maryland, Rogoff’s Anchorage attorney, Adam Cook, was telling creditors that she was likely to file for personal bankruptcy: “Now that her personal finances are public knowledge, the stigma is gone, and bankruptcy appears to be her best option,” he wrote in October.

Cook was telling her creditors that Rogoff could just throw in the towel, declare bankruptcy, and leave them with nothing. Better for them to settle for a fraction of what they were owed.

“Right now,” Cook wrote, “appeals are being made to third parties, seeking personal contributions that will allow Ms. Rogoff to settle with her creditors and move on rather than going into bankruptcy. It was on the basis of these third-party contributions that Ms. Rogoff was able to extend an offer to Arctic Partners a few weeks ago in the amount of $475,000. It is still possible that Ms. Rogoff and Arctic Partners will broker a settlement.”

What third parties gave Rogoff the money to settle with some creditors and not others? The key word here is “her creditors.” Creditors are trying to convince the court that she and her businesses were indistinguishable.

The letter does not say where she got the money from nor under what circumstances. Was she pressuring Rubenstein to bail her out, before she signed the divorce papers?

“Ms. Rogoff needs to know if it is possible to reach a number with M&M Wiring. If she can’t reach such an agreement, and she files a petition in bankruptcy, then the litigation will become about between M&M Wiring and Arctic Partners. Frankly, I expect that such litigation would be pretty ugly,” Cook continued. “An offer from Ms. Rogoff is probably the last time M&M Wiring can expect to see ‘cash on the table’ for quite a while.”

“I don’t like couching offers with the threat of debtor bankruptcy (let’s face it, debtors are often blowing smoke). But I wanted to give this thing one more shot. Let me know. Thanks.”

TIMING IS EVERYTHING

Cook’s letter to attorney Wayne Dawson was dated Oct. 12, 2017.

The next day, the Iceland Arctic conference would start. Rogoff would appear with the Russian ambassador for Arctic Affairs, and other circumpolar glitterati. The agenda of the conference can be found here.

Rogoff had already traveled to Russia in late March for a polar conference hosted by Vladimir Putin, and to Nantucket for a sailing regatta just days after declaring bankruptcy in August. She spent time in D.C., and kept traveling the globe.

WHAT ROGOFF TOLD THE PUBLIC WEEKS EARLIER

Rogoff had sold the newspaper to the Binkley Company weeks before. In her farewell column to readers, she wrote for publication on Sept. 12, 2017:

“We are fortunate that this legal (bankruptcy) process exists, giving a company like ours protection from creditors while reaching for a solution to the most urgent challenges. Of course, I am deeply sorry there are vendors whose bills will go unpaid. And I dread the prospect of layoffs at the paper that will be necessary for it to survive under its able new owners. These are the hard realities of business gone bad.”

COOK IN THE KITCHEN?

The distinction between Rogoff as an individual with debts and Rogoff as the owner of a corporation with debts is a tangle for the best bankruptcy minds. Her lawyers are trying their best to keep her personal finances safe from creditors.

Adam Cook, the author of the letter explaining her likelihood of personal bankruptcy, is a partner at the law firm that is defending her personally, as well as representing AK Publishing, Alaska Dispatch News, Moon and Stars LLC. The tangle of corporations owe a lot of money to a long list of creditors. Even the law firm itself is a creditor.

But Cook appeared to serve informally as something more than a lawyer. In early 2017, he acted more like a project manager for the renovation of the Arctic Partner building, where Rogoff was trying to move all of the Dispatch operations last year.

His involvement with possibly running an aspect of her business may be an important key in a segment of the bankruptcy proceedings. The court filings include a memo from Cook to M&M Wiring directing them to proceed on work and continue to submit invoices.

The court may wonder if Cook is acting as an attorney for Rogoff, but also has qualities of a witness who was an actor in the very issues that are now subject to the bankruptcy proceedings. Can he be both?

Monday is the next bankruptcy mediation date for Rogoff. The Chapter 7 trustee Christine Tobin-Presser will mediate between Rogoff and Northrim Bank, over a separate issue involving the personal loan she took out from Northrim to purchase the Anchorage Daily News back in 2014. It is possible both the interest and principal of the loan may have been paid by the corporation, not by her, a detail that will matter to the bankruptcy trustee. And it further entangles Rogoff as she tries to keep her personal finances separate in the bankruptcy proceedings.

Wednesday is Rogoff’s next date for a deposition with Arctic Partners and M&M Wiring, where they will be able to ask about her personal finances and her divorce settlement. Arctic Partners compelled her attendance for June 6. It’s always possible, however, that a settlement will be reached before her divorce settlement details are outlined to her creditors under oath.

WHAT ABOUT ARCTIC TODAY?

Rogoff now is the publisher of Arctic Today, with a polar focus. A year ago in June, Rogoff was talking about Dispatch’s exciting new product:

But by the fall of 2017, Rogoff told the court it was worth nothing and convinced the judge to let her keep it. The Binkley Company didn’t want it, and the court decided it wasn’t worth including as a business asset. It was a small victory in a series of traumatic failures, allowing her to retain the one asset that doesn’t need to make money, now that her divorce is final, but would burnish her brand on the global stage.

Now, she just has to wear down the creditors of her former business interests that are now in Chapter 7 bankruptcy.