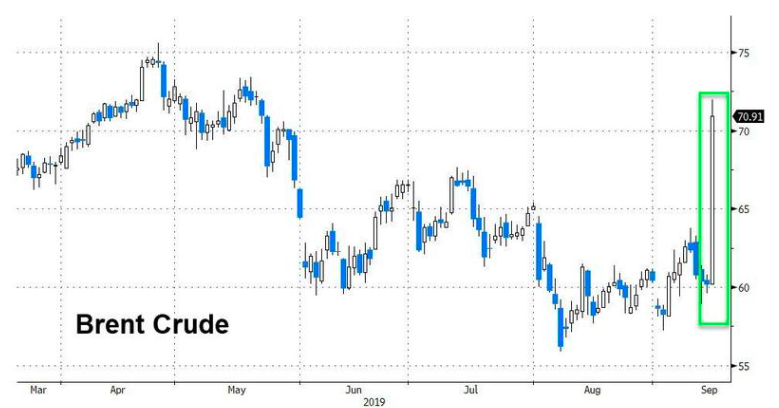

U.S. oil futures advanced about 12 percent to $61.60 a barrel shortly after trading opened at 6 p.m. Eastern Time in Asian markets.

Brent crude jumped 13 percent to nearly $70 a barrel, before retreating a bit. New York trading starts Monday morning, and the commodities markets will most likely be frenetic.

On Saturday, several drone strikes on two Saudi Arabian oil refineries took half of that country’s oil production offline, representing about 5 percent of the world’s daily production of crude oil. Yemen’s “Houthi” rebels claimed responsibility.

[Read the attack report from the Iran Press point of view here.]

Bloomberg reported, “For oil markets, it’s the single worst sudden disruption ever, surpassing the loss of Kuwaiti and Iraqi petroleum supply in August 1990, when Saddam Hussein invaded his neighbor. It also exceeds the loss of Iranian oil output in 1979 during the Islamic Revolution, according to data from the U.S. Department of Energy.”

Morningstar research director, Sandy Fielden was reported saying that, “Brent could go to $80 tomorrow, while WTI could go to $75… But that would depend on Aramco’s 48-hour update. The supply problem won’t be clear right away since the Saudis can still deliver from inventory.”

Fielden was quoted by the New York Times: “The price (of oil) is going to jump all right, but the Saudis and U.S. have a day to run interference on their positions before then. The most scary result would be a Saudi escalation of the war in Yemen. Then the whole Gulf gets trigger-happy.”

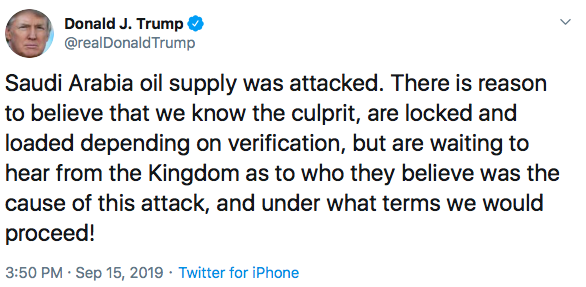

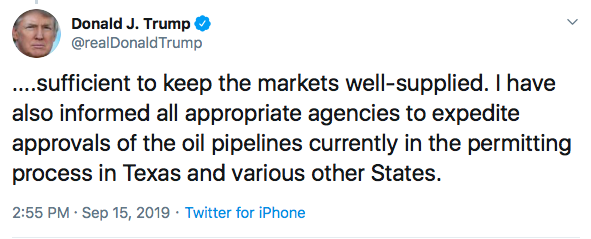

President Donald Trump added his two cents on Twitter, saying he’ll open up strategic oil reserves and wants pipeline permits expedited.

Alaska tracks closer to Brent than WTI. Brent is expected to pop up again on Monday morning, and Alaska North Slope crude will follow. Alaska’s oil, like Brent, gets a premium that could mean as much as $7 per barrel more than WTI.

THE ALASKA PRODUCTION SWEET SPOT

Alaska’s budget woes could benefit from $80 a barrel oil, but only if production is maintained above the 500,000 per barrel, per day mark.

With the Willow and Pikka fields still awaiting their final investment decisions by ConocoPhillips and OilSearch, Alaska could shoot itself in the foot with the Fair Share oil tax ballot initiative that former Gov. Bill Walker’s ally and business partner Robin Brena is spearheading.

Final investment decisions for the billions of dollars needed to open up these promising fields could be put on the back burner while companies charge full steam ahead to develop other fields around the country that look more promising, with fewer headaches and lower taxes, experts told Must Read Alaska.

It doesn’t matter. We grow our own here.

No, the President opened the oil supply from the National Petroleum Reserve. There will not be a shortage of oil on the US markets.

No, there will not be an oil shortage in the United States, but the price will rise.

Why wouldn’t it jump upward? It’s a commodity just like others.

So, as commodity prices rise and fall, so will North Slope Crude.

It’s simple Economics-101.

Amazingly it’s less volatile to operate in Alaska than a permanent war zone. Who would have thought?

.

How much easier to target a supertanker in the Strait of Hormuz with a remote torpedo?

15% jump. Might be a new reality has set in, the middle east isn’t a stable environment.

Comments are closed.