Unregulated crypto currency traders funding political campaigns. What could go wrong?

News broke this week that the FTX currency exchange, similar to a Ponzi scheme, crumbled and took down the investments of millions of people.

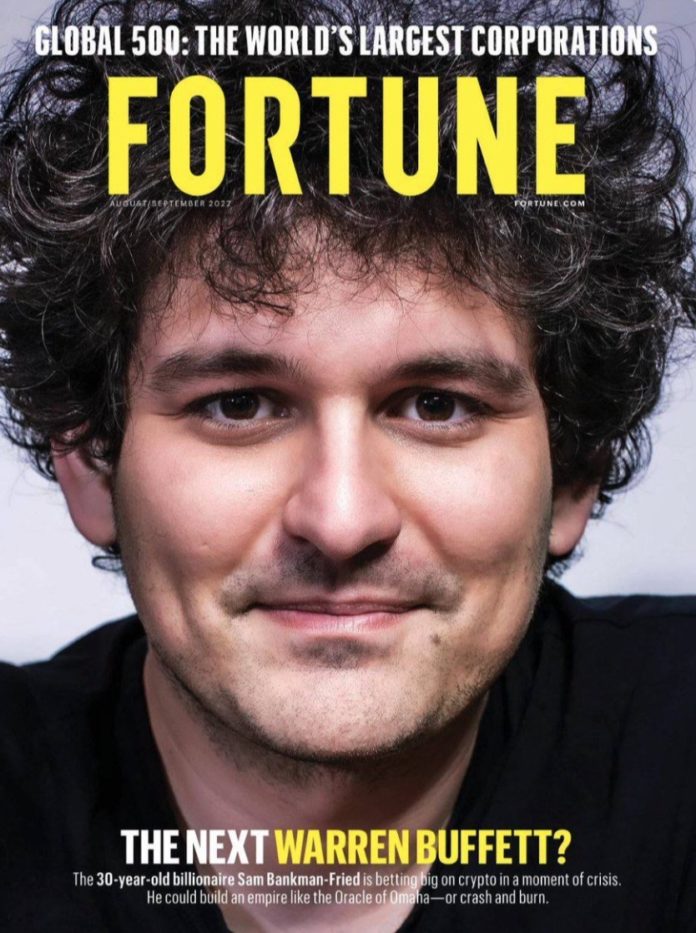

The 30-year-old founder of FTX, Sam Bankman-Fried, who operates outside the United States, resigned Friday as the company declared bankruptcy. A caretaker CEO who helped Enron recover from bankruptcy has come in to try to usher the company through the bankruptcy process. (This is not investment advice, but if you are invested in FTX, you won’t see your investment back any time soon.)

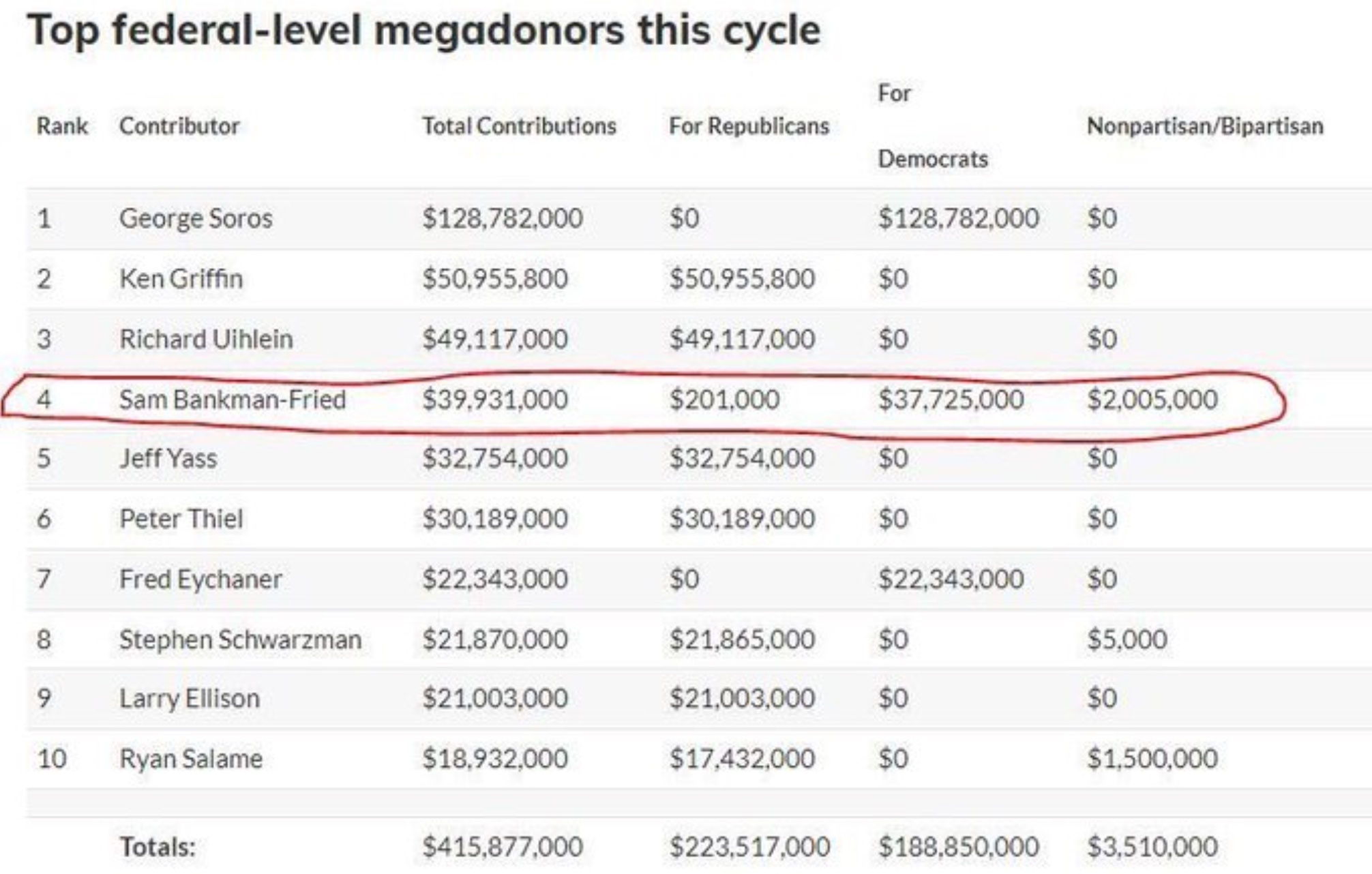

Bankman-Fried, who conned billions of dollars out of people and transferred tens of millions of dollars to Democrat campaigns, was the Democratic Party’s second-largest donor this year, after well-known Democrat funder George Soros.

His operation was, in essence, a money-laundering scheme for Democrat campaigns. At the same time, Bankman-Fired was buying influence in Congress, as a key player in stopping the “red wave” that was to be the 2022 elections.

To help flip Alaska blue, Bankman-Fried donated $6 million to the Democrat House Majority PAC, which in turn donated $5,000, the maximum amount allowed, to the campaign of Alaska’s Democrat Congresswoman Mary Peltola.

FTX is a decentralized cryptocurrency exchange founded by the MIT graduate in 2018. It was primarily focused on derivatives, options, volatility instruments, and leveraged tokens.

Bankman-Fried “stormed on to the US political scene with multimillion-dollar donations that led lawmakers, particularly Democrats, to believe he was ushering in the next generation of donors. But in a matter of days, his business empire collapsed into bankruptcy and the prospect of millions more in donations evaporated,” writes the Financial Times on Sunday.

In 2020, Bankman-Fried was the second-largest donor to get Joe Biden elected president, also after No. 1 George Soros. Bankman-Fried was only 28 years old at the time and had only been in the crypto business for about 1-2 years.

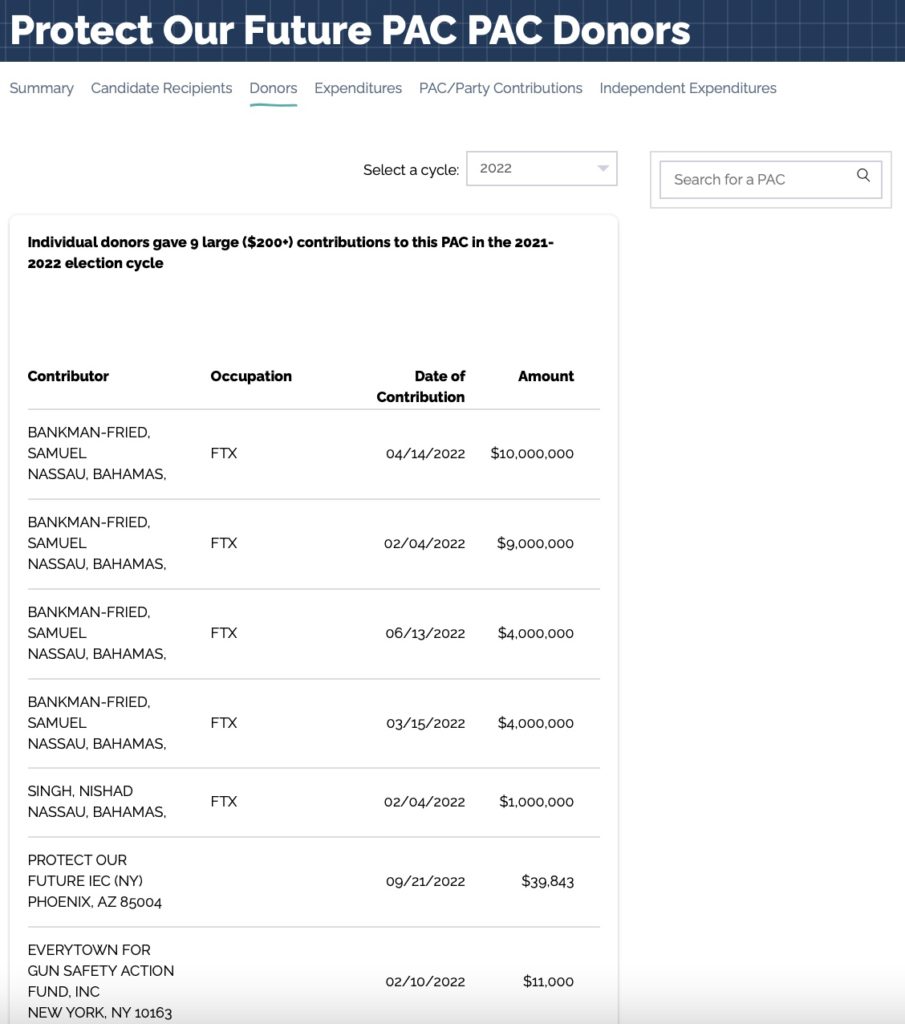

The majority of Bankman-Fried’s donations to Democrats — about $28 million — was through the Protect Our Future Pac, which used the funds to support 25 Democrats in congressional races. Of those, 18 have won their races, including Virginia’s Abigail Spanberger and Florida’s Maxwell Frost, a 25-year-old.

But for Bankman-Fried, it was more about furthering his crypto businesses. He intended to influence public policy and gave to some right-leaning political action committees. But only about $155,000 went to Republicans, such as Alabama Sen.-elect Katie Britt, who was an ally, and Arkansas Sen. John Boozman. Bankman-Fried also donated to the campaign of Sen. Debbie Stabenow, the Senate Agricultural committee overseeing crypto, which Boozman also serves on.

Some politicos said they suspected Bankman-Fried’s primary goal in politics had been to further his crypto interests through the political process. Elon Musk, the world’s richest man, said he had not heard of Bankman-Fried until people started mentioning him as a potential investor in Twitter. “But then I got a ton of people telling me [that] he’s got, you know, huge amounts of money that he wants to invest in the Twitter deal. And I talked to him for about half an hour. And I know my bullshit meter was redlining. It was like, this dude is bullshit – that was my impression.”

One of Bankman-Fried’s other interests was to elect lawmakers to the House of Representatives who would focus on pandemics. He was one of the founders and was the main funder of a group called Guarding Against Pandemics, a political influencer run by his brother, Gabe Bankman-Fried, who was an adviser to Democratic political action committees and was a staffer to Democrats in the U.S. Capitol. The purpose of the group was to ostensibly work on preventing the next Covid pandemic, but it may be another political scam or money-laundering operation.

At the peak of his crypto scheme, the Bankman-Fried was said to be worth $26 billion. At the beginning of last week, his worth was pegged at $16 billion. At the end of the week, it was pegged at zero.

Bankman-Fried’s other crypto company, Alameda Research and Weste Realm Shires Services (known as FTX.US), are are embroiled in the same meltdown, which has also entangled other crypto companies as the fallout continues.

Bankman-Fried is now in the Bahamas, where he is likely a flight risk to a jurisdiction that has no extradition treaty with the United States. The United States has extradition treaties with about 107 countries.