The Department of Revenue’s Spring 2023 Revenue Forecast brought tough news for Alaska on Tuesday. The projected price of oil is down, leaving a hole in the budget for this fiscal year, as well as for FY 2024, which starts in July. The hole looks like about $925 million in total, and there seems to be little agreement on how to make ends meet. Almost certainly, it will mean a bite out of Alaskans’ Permanent Fund dividends.

Gov. Mike Dunleavy has proposed a full $3,700 dividend, at a cost of $2.47 billion, while the House Republican majority is now looking at a $2,700 dividend and the Senate majority is discussion one that is closer to $1,300.

Unrestricted General Fund revenue, before accounting for the transfer from the Permanent Fund Earnings Reserve Account, is forecast to be $3.6 billion for Fiscal Year 2023 and $2.7 billion for Fiscal Year 2024.

The Permanent Fund is set to transfer $3.4 billion to the General Fund for FY 2023 and $3.5 billion for FY 2024, according to the Department of Revenue. These amounts include funds that are available for general government spending and the payment of dividends to Alaskans.

Permanent Fund transfers remain a large source of funding to the General Fund, and are now responsible for 44% of undesignated general fund spending for 2022. The Permanent Fund is projected to contribute 48% to 64% of the FY 2024 to 2034 budgets.

In 2022, Alaska North Slope oil prices averaged $91.41 per barrel. The revenue forecast incorporates the most current indications from financial markets and is based on an annual average ANS oil price of $85.25 per barrel for FY 2023 and dropping down to $73 per barrel for FY 2024. Prices are expected to decline beyond FY 2024, stabilizing at $70 per barrel by FY 2032.

In FY 2022, ANS oil production averaged 476,500 barrels per day. ANS oil production is expected to average 485,200 barrels per day for FY 2023 and 496,400 barrels per day for FY 2024, before climbing to 542,900 barrels per day by FY 2032. with the Willow Project coming online.

In comparison to the Department’s Fall 2022 Revenue Forecast, which was released in December 2022, the ANS oil price forecast has decreased by $3.20 per barrel for FY 2023 and $8 per barrel for FY 2024.

The ANS oil production forecast decreased by 6,500 barrels per day for FY 2023 and by 7,200 barrels per day for FY 2024.

Driven by this lower outlook for oil price and production, the Unrestricted General Fund revenue forecast has decreased by $246 million for FY 2023 and $679 million for FY 2024, the Department of Revenue said.

The Spring Revenue Forecast is an annual update to the Fall Revenue Sources Book, providing basic information about state revenue, as well as a forecast of state revenue over the next ten years. The Revenue Forecast is available on the Department’s website at www.tax.alaska.gov.

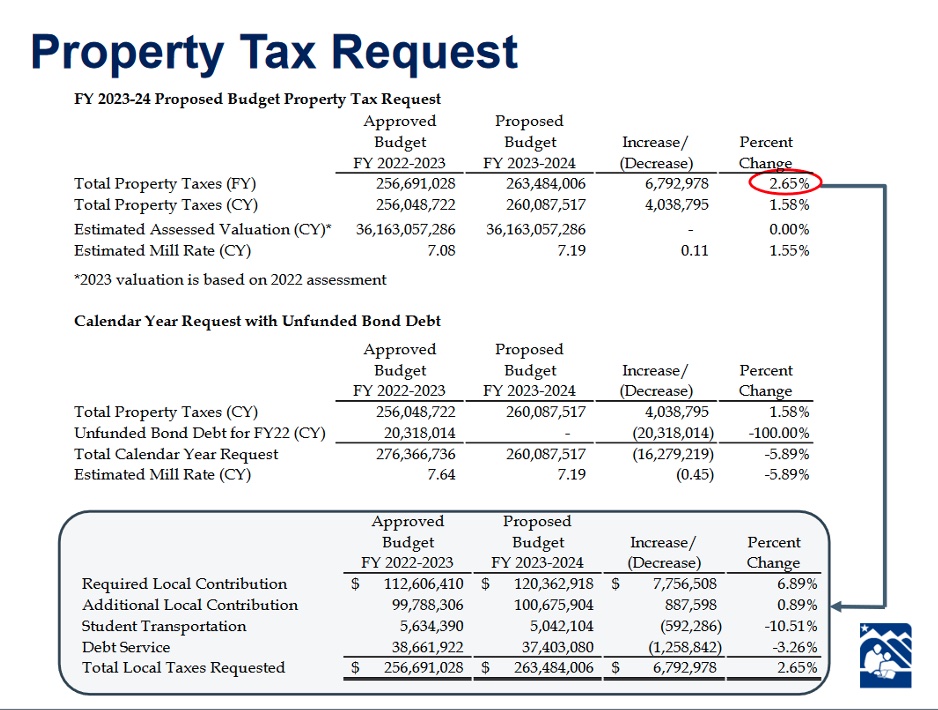

The announcement came on the same day that a House Education Committee hearing attracted numerous teachers and principals who asked the the House pass House Bill 65, which would increase the school spending formula. The state spends about $1.23 billion on education every year. If the Base Student Allocation is increased by another $1,250 per student, as proposed by HB 65, the cost to the state budget would be more than $164 million per year, according to some estimates that are based on 131,212 enrolled students.

HB 65, sponsored by Rep. Daniel Ortiz, would give a set formulaic increase to school districts, which have great latitude as to how they spend the money the state gives them.