With the Kenai Peninsula Borough’s October 7, 2025, election nearing, two citizen-initiated ballot measures—Proposition 1, mandating manual hand-counting of in-person ballots and eliminating electronic tabulators, and Proposition 5, aligning local elections with state and federal November dates—are at the center of debate.

The Borough Assembly’s $34,000 voter education campaign, launched in September 2025, aims to inform residents about these measures but has drawn scrutiny for highlighting only their challenges, omitting potential benefits. This approach raises questions about compliance with Alaska election laws, which require neutrality in public-funded efforts.

Here’s a look at the campaign’s details, its legal implications, and options for voters.

The Campaign: Focus on Challenges

On September 3, 2025, the Assembly unanimously approved Ordinance 2025-19, allocating $34,000 for a voter outreach campaign on Propositions 1 and 5, managed by Borough Clerk Michele Turner. The campaign includes digital ads on platforms like Facebook, infographics on the Borough website kpb.us, and radio ads broadcast to the peninsula’s approximately 58,000 residents.

For Proposition 1, the campaign notes increased staffing needs and costs for manual ballot counting, with Vice President Kelly Cooper emphasizing during Assembly discussions the “unknown price tags” voters should understand. For Proposition 5, it highlights logistical hurdles, such as disrupted election agreements with cities like Soldotna, Homer, and Kenai, which could keep municipal races in October, requiring the Borough to hire separate workers and purchase materials.

The Borough’s factsheets for both propositions provide neutral ballot language but direct voters to campaign materials for context, which focus solely on these challenges. Notably, the campaign does not mention potential benefits.

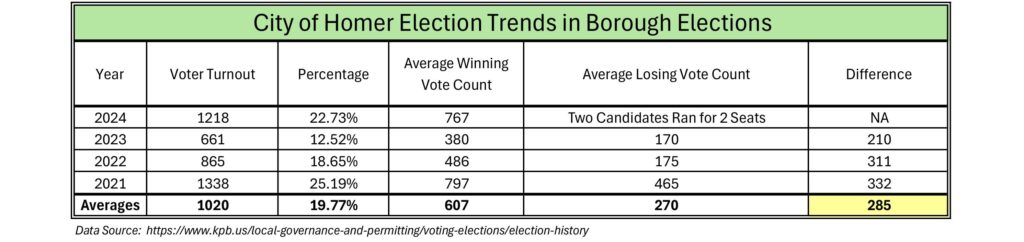

For Proposition 1, there is no reference to possible gains in public trust from manual counting amid national election security concerns. For Proposition 5, it omits data from boroughs like Matanuska-Susitna, where aligned elections boosted turnout to 41% in 2024, compared to Kenai’s 25% in recent non-federal years. This selective focus aligns with the Assembly’s 2023 decision to reject election alignment (7-2 vote), favoring a Voter Turnout Working Group instead.

Legal Questions Under Alaska Election Law

Alaska’s election laws, governed by Title 15, regulate public spending on voter education. AS 15.13.145 prohibits using public funds to influence election outcomes, including ballot measures, to avoid the “appearance of corruption” (AS 15.13.010). Voter education must be “factual and impartial,” per Alaska Public Offices Commission (APOC) guidelines, and expenditures over $500 require disclosure (AS 15.13.090).

State election pamphlets (AS 15.58) include balanced arguments for and against measures. The Borough’s campaign, by emphasizing only challenges, could be seen as indirectly opposing Propositions 1 and 5, potentially violating AS 15.13.145.

APOC has pursued similar cases: in 2023-2025, anti-ranked-choice voting groups faced $157,000 in fines for biased communications and non-disclosure. A 2021 case, Alaska Policy Forum v. APOC, flagged educational materials for skewed framing, noting that omissions can mislead voters. Penalties for violations include fines up to $102,000 (three times the campaign cost), corrective disclosures, or misdemeanor charges (AS 15.13.390).

With absentee voting underway, an APOC complaint could disrupt the campaign or trigger post-election audits.

Voter Options Before Election Day

Voters seeking to address the campaign’s one-sided approach have several paths:

- File a Complaint: Residents can submit complaints to APOC at doa.alaska.gov/apoc, citing the campaign’s omission of benefits (e.g., Prop 5’s turnout potential). Contact: (907) 276-4176 or [email protected]. Complaints may prompt investigations within 30-90 days.

- Access Full Information: Review proposition texts at kpb.us/elections. For Prop 1, consider security benefits versus costs; for Prop 5, note Mat-Su’s turnout gains.

As the Borough navigates these contentious measures, the campaign’s focus on challenges alone has sparked concerns about fairness. Influencing election outcomes by elected officials is a serious matter, as is violating state election laws. Both propositions are intended to improve election integrity and voter turnout. What are the Assembly’s actions intended to do?

Ben Carpenter is a former Alaska state legislator, combat veteran, small business owner, host and producer of the Must Read Alaska Show podcast, and newly hired CEO of Must Read Alaska. Ben is also the sponsor of Ballot Proposition 5.