TRUSTEES HEAR PITCHES ON ENVIRONMENTAL INVESTING

The Alaska Permanent Fund’s investments gained 8.86 percent through the third quarter of fiscal year 2018.

The fund ended March with assets totaling $64.6 billion.

Over the last five years, the fund has returned 8.35 percent, and that compares to a return of 6.52 percent over the last 20 years, which includes the financial crash of 2008-2009, when the value of the fund fell to $26 billion after a peak of $40 billion in 2007.

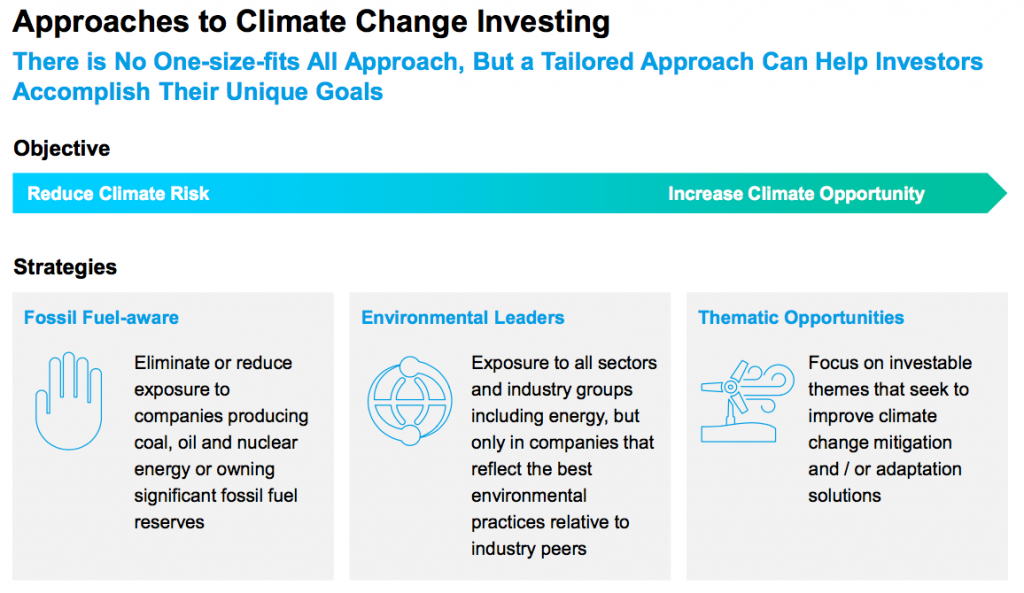

The Board of Trustees met for its quarterly meeting last week in Anchorage to review the performance and risks of the fund’s assets, and to hear a presentation on investing in alternative energies in a strategy called Environmental, Social, and Governance (ESG) investing.

The trustees heard from a former Obama White House official who now works at Blackrock investment group. Brian Deese, the managing director and global head of sustainable investing at BlackRock, was President Obama’s senior advisor for climate and energy policy, helping to negotiate the Paris Climate Agreement and other national and international initiatives.

Deese told the Permanent Trustees that he believes sustainability-related issues including board composition, human capital management, and climate change – have real financial impacts. Those who engage in ESG investing do better, he said, than those who don’t.

“They are more competitive than their peers because they more efficiently use their resources, and/or have better human capital management as well as better manage long term business plans. This leads to higher profitability and higher dividends,” his presentation materials said. “They are less vulnerable to systematic market shocks and therefore show lower systematic risk. Lower systematic risk means a lower beta, which translate to lower cost of capital and a higher valuation. Further valuation is increased through the increased size of investor base.”

Similar presentations were made by John Goldstein, Goldman Sachs’ managing director, ESG and impact investment client strategy; and Hilary Irby, Morgan Stanley’s managing director and co-head of global sustainable finance.

The presentation materials are linked here:

2018_05_23-24_APFC_Board-of-Trustees-Quarterly-Meeting-Packet

Many of the Permanent Fund’s external managers already incorporate ESG strategies alongside their traditional strategies, according to a news release from the Alaska Permanent Fund Corporation. The trustees seemed disinclined to stray from their current successful investment strategy and adopt the carbon-free model.

Groups have attempted to persuade the Permanent Fund in the past to invest in Alaska projects, and Gov. Bill Walker in 2016 asked the trustees to consider buying up the distressed debt the State owed to oil explorers due to the nonpayment of tax credits by the Walker Administration.

The Permanent Fund trustees also reviewed legislative actions including Senate Bill 26, establishing a percent of market value (POMV) draw of $2.7 billion from the Earnings Reserve Account to fund general government services and the dividend program for Alaskans who have lived in the state for one year or longer.

The Legislature implemented a statutory structure for using Permanent Fund’s earnings with the passage of SB 26, limiting appropriations to 5.25 percent of the market value for 2019, 2020, and 2021, and then stepping down to a 5 percent draw beginning on July 1, 2021.