Glenfarne Group, LLC, the majority owner and lead developer of the Alaska LNG project, has selected global engineering firm Worley to carry out additional engineering and deliver the final cost estimate for the proposed pipeline.

The selection marks a pivotal step forward for the long-anticipated $39 billion Alaska LNG project, a joint venture with the Alaska Gasline Development Corporation, the state’s independent energy infrastructure agency.

Worley, which has operated in Alaska’s North Slope region for over 60 years and has a longstanding presence in the state’s energy sector, will expand its role to become a key advisor to Glenfarne on all components of the project. In addition to refining the pipeline’s engineering scope and updating its cost estimate, Worley will also take on responsibilities related to the development of the Cook Inlet Gateway LNG import terminal.

The final cost estimate is a required step before Glenfarne makes a final investment decision (FID), which is expected later this year, the company confirmed in the announcement.

“The declining gas production from Cook Inlet risks Alaska’s energy security, as well as U.S. national security and military readiness,” said Brendan Duval, CEO and Founder of Glenfarne. “Prioritizing the development and final investment decision of the pipeline is essential to solving the natural gas shortages which are already impacting the state.”

Duval emphasized Glenfarne’s commitment to accelerating the project timeline and engaging potential strategic partners. He also highlighted Worley’s experience both globally and in Alaska: “We are particularly proud to be expanding our relationship with Worley to Alaska LNG from our existing partnership on the Texas LNG project,” he said. “Worley is one of the world’s largest and most experienced engineering and project delivery firms with a long history of success in Alaska.”

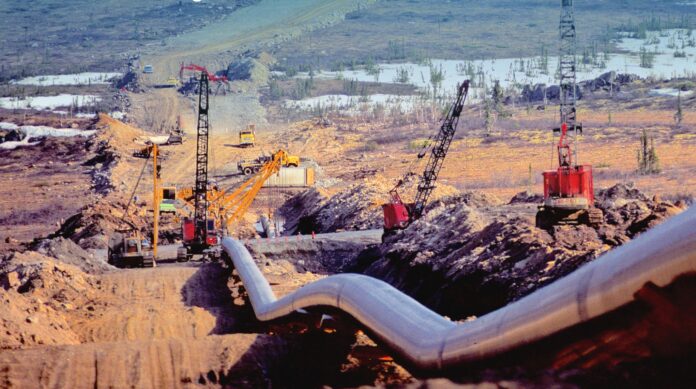

The Alaska LNG project, envisioned to transport North Slope natural gas through an 800-mile pipeline to a liquefaction terminal in Nikiski, has experienced numerous delays and shifts in strategy over the past decade. The project stalled under former Gov. Bill Walker, who sought communist Chinese state investment and control. It has since regained momentum under Gov. Mike Dunleavy, with a focus on American-led development and energy security.

Worley’s client history in Alaska includes work with NANA Regional Corporation, one of the state’s 13 regional Native corporations, signaling deep industry ties that may prove beneficial in navigating the regulatory and logistical hurdles ahead.

The updated engineering and cost work will build upon previously completed studies and designs, bringing the multibillion-dollar megaproject one step closer to groundbreaking.