In a move poised to extend vital natural gas production amid looming shortages, the Alaska Department of Natural Resources approved Hilcorp Alaska’s plan amendment on October 7, 2025, to upgrade infrastructure at K Pad in the Beluga River Unit (BRU). The project, targeting three new wells, will enhance gas extraction from the Cook Inlet field, directly supporting the energy needs of Southcentral Alaska’s Railbelt utilities, including Chugach Electric Association.

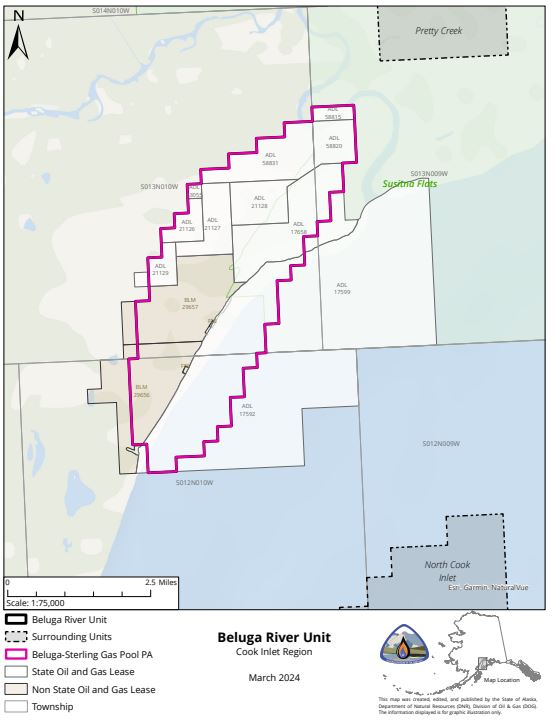

Located on the west side of Cook Inlet, roughly two miles west of the Beluga River’s mouth, K Pad’s enhancements include installing well cellars and conductors, subsurface flowlines, three separator skids, a line heater skid, and relocating a 10,000-gallon produced water tank from B Pad. The Division of Oil and Gas reviewed the September 18 proposal under state statutes, with no comments from agencies like the Department of Environmental Conservation or U.S. Army Corps of Engineers.

This expansion is critical as Railbelt utilities face expiring Hilcorp contracts by 2028, threatening power reliability for over 90,000 rate payers. Chugach, holding a two-thirds working interest in BRU, relies on the field for 60% of its gas. Chugach stated in its power generation update, they have co-invested in 15 new wells at BRU with Hilcorp, and five more wells are planned for 2025, underscoring the project’s role in bridging supply gaps before LNG imports ramp up.

The upgrade aligns with 2018 Cook Inlet mitigation measures, promoting efficient development without new land claims. While Hilcorp must secure additional permits, the decision advances Alaska’s energy security, potentially averting price spikes for households and businesses.